Sri Lanka’s economy is still gasping for breath. Weakened by decades of fiscal and external deficits, pummelled by near-sighted and ill-advised tax cuts and money printing and brought right to edge by a shaking global crisis, it’s easy to be pessimistic about the country’s future.

It’s easy to forget that over the last few months, we HAVE been taking steps, however tentatively, towards a resolution, however imperfect it may end up being.

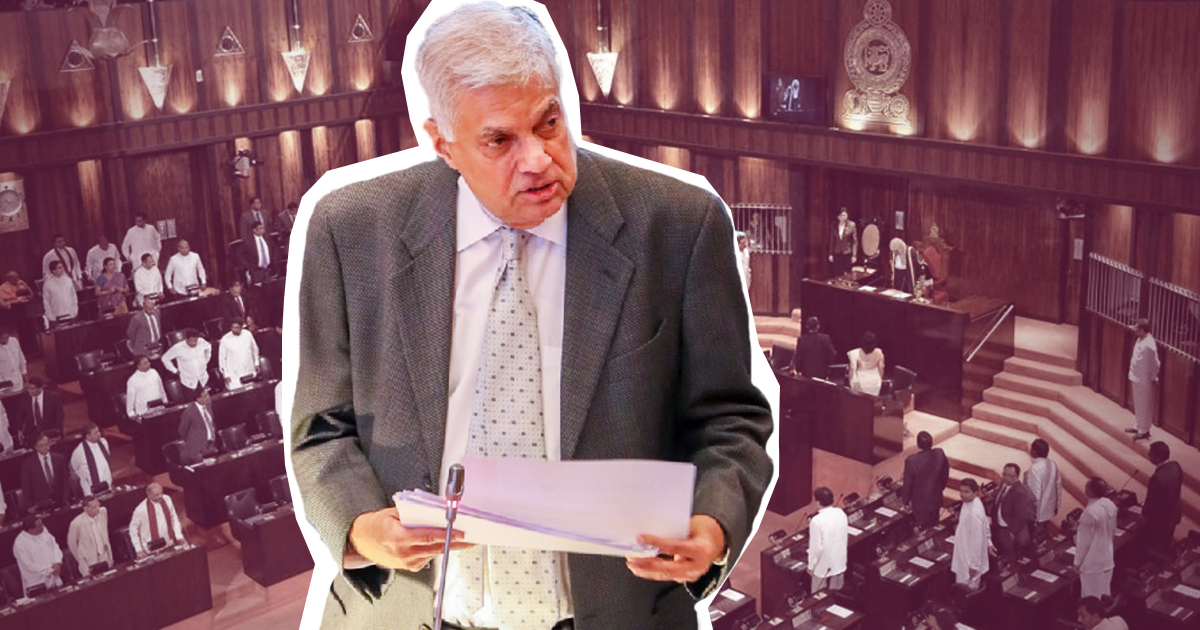

The upcoming interim budget is one step that should help us stand a little steadier in the months to come and help the country come out of this pit that we’ve dug ourselves into. But what should this budget include and what can actually help us? Let’s take a look.

A Quick Look Back In History – Why Sri Lanka needs budgetary reform

For most of its post-independence history, Sri Lanka has run significant deficits in the budget – leading to the government having a gap between the rupees it needed for expenses and the rupees it collected in revenue. The only way to bridge this was to get some money from somewhere else, i.e., to borrow.

Something else happens as well when the government borrows money it doesn’t have and spends it: People use this money to consume more than they previously could have. In Sri Lanka, consumption means imports (either directly, like the fuel for our vehicles or indirectly, like raw materials, machinery, and energy for local production).

Consistent budget deficits, in my view, are a key reason why Sri Lanka has maintained a negative dollar balance as well; this is because we use our resources to consume and import, rather than save, invest, and export. This negative balance once again has to be bridged with some money, which is where debt comes in again.

So while there are probably thousands of problems in Sri Lanka’s economy, I think budgetary reform can fix many of our problems – if done correctly, of course.

The big question – raise taxes or cut spending?

Our revenue is pitifully low in Sri Lanka. We have one of the worst revenues in the world (relative to the size of our economy). If all the countries of the world were people in a city, Sri Lanka’s revenue numbers would make us someone living in absolute poverty. Looking at this story (and the numbers behind it), it’s very clear to me that Sri Lanka HAS to raise its revenue.

The easiest first step is to reverse the 2019 tax cuts. From that base, we then have to think about how we can increase our revenue while making sure the burden Does not fall onto the poorest among us.

While there might be no option other than to use the pre-2019 system for the short term, we should definitely move away from relying on indirect taxes for the majority of our revenue. This means raising direct taxes, reducing and removing random concessions, and making more people eligible for direct tax – progressively.

The question of expenditure is more complicated. There are definite issues in WHAT we spend our limited earnings on (for example, if the way we have hired into public service really makes sense and whether we need to keep doing that). At the same time, there’s a serious issue with how the massive losses of our State Owned Enterprises (SOEs) have led to insane debt problems for the financial system (a complicated topic for another time – but in short, dealing with SOE reform is primarily critical for financial system stability in my view, rather than budgetary reasons).

However, the total expenditure number isn’t as high in comparison to other countries. In fact, our expenditure relative to the size of our economy has been broadly FALLING over the last two decades. I think, therefore, while we deal with the underlying expenditure issues separately, we shouldn’t be too focused on reducing the topline expenditure number. The numbers don’t suggest that we have a general ‘too much expenditure’ problem, but rather multiple specific issues that might not even be solved by ‘cutting expenditure’. No point in burning your clothes just because you have a lot of trousers.

The specific issues definitely have to be dealt with. Misallocation of resources means that some expenses are higher than they should be (both when we consider our overall low revenue, but even in absolute terms). This means reallocating resources needs to be a key priority of budgets moving forward and limiting the increase in expenditure in these areas. So don’t buy more trousers, and wear some of them at home

However, there are areas in which we clearly don’t spend enough. Reallocation means moving resources from areas that don’t deserve them, into places that need them. Health and education expenditure is the obvious place to spend more, but especially in the middle of a crisis, targeted welfare support should also be a key priority. Of course, it’s important to not let vested interest groups (both personal and ideological interests) use welfare as an excuse to push government support to the rich. While not strictly budgetary, fixing administrative issues in the current welfare system must also be a top priority.

What Next – What Will We End Up With?

What’s coming up is only meant to be an interim budget for 2022, with a full budget for 2023 expected to be presented in November. In my view, this budget should also stick to this pathway and future budgets must build on this as well. If we do stick to the whole plan, a few years down the line, we can be confident that we’ve left crises behind us and we can look forward to a glorious new age of prosperity.

Reality will likely not go all the way. There will be plenty of vested interests arguing against these policies, both through direct government lobbying as well as through pushing narratives in society. It’s altogether possible that we end up with more damaging versions of the budgetary reform instead. It’s up to us to be vigilant and try to push for as much good policy as possible. It’s possible we won’t see everything turn out bright and sunny with our budgets, but I feel we’ll be able to see a little blue sky among the clouds, not too far into the future. With all the bleak grey that we’re in today, reaching for that little bit of colour sounds worth it to me.

Thoughts reflected here are the writer’s personal views and do not reflect that of an employer.

Chayu Damsinghe is the Product Head of Macroeconomic and Thematic Research at Frontier Research understanding economic crises across history and applying them to Sri Lanka’s situation

.jpg?w=600)