In 2014, the then Governor of the Central Bank of Sri Lanka had a Q&A session on Twitter. One of the most repetitive questions to him was, “When are we getting PayPal inward remittance enabled for Sri Lanka?” Two years later, the question still stands.

In the meantime, Sri Lankan Minister Harin Fernando announced last week that Sri Lankans will soon get to utilise the services of Stripe, a relatively new startup, which offers online payment processing services like PayPal. According to the Minister, we could witness the launch as early as mid April this year.

The big question is, what does Stripe’s entry mean to the local business scene and why is it important to bring in PayPal or similar services to Sri Lanka? While we try to answer these questions, let’s first take a closer look at how online payment processing works.

Setting up an e-commerce website in Sri Lanka is not a hard task. But that is just one part of the picture; getting customers to buy from you is a different story altogether. One of the struggles faced by any entrepreneur (and even freelancers, charity funds etc.) is accepting payments online. Sri Lankans do prefer paying for their goods at delivery (CoD), but the hassle free way of paying online has seen a steady growth nevertheless. Additionally, businesses need to adopt online payment options to stay ahead fo the game.

How Does One Accept Payments Online?

For the purpose of this article, by ‘paying online’, we refer to the credit/debit card payments made online. Letś take the traditional way of accepting card payments. In Sri Lanka, banks are the prominent financial institutions that offer the service to accept card payments. They act as a link between merchants and credit card processing companies. Merchants are required to have a merchant account to access these services. A merchant account is a special account that is used to capture the funds from card sales. So when you make a payment online, the money is first held in the merchant account, before being transferred to the merchant’s personal account on a pre-agreed time interval.

Moving to online payments, you will require a payment gateway in addition to the merchant account to set things up on your own. These are once again provided by Sri Lankan banks. But the inconvenience of obtaining a payment gateway from a Sri Lankan bank (especially if you are a small entrepreneur or a startup), and the exorbitant cost involved, have made this process mostly undesirable locally. That however is a different story entirely, although if you’d like to learn more, you could check this article out.

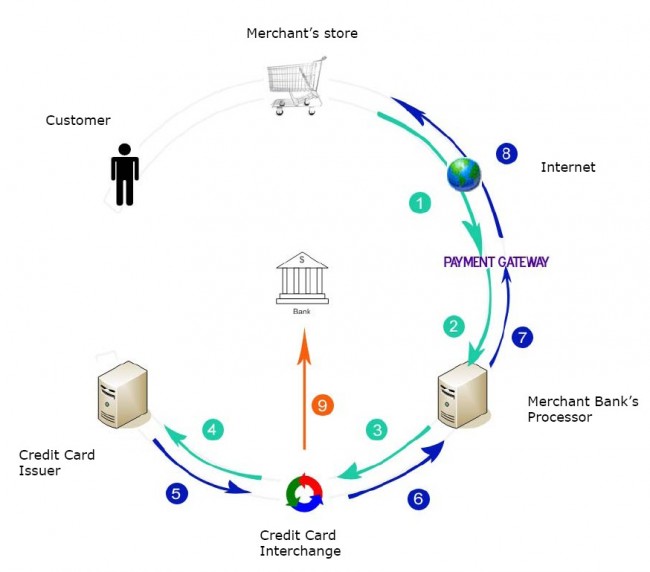

Transaction flow

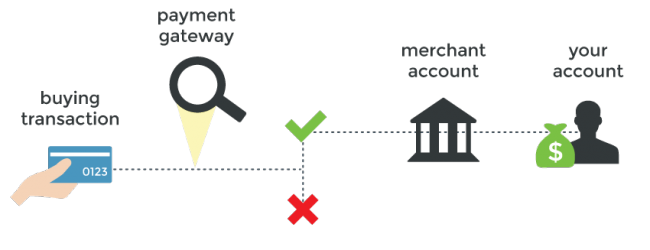

What Are Payment Gateways?

When processing a credit card transaction, there needs to be an option to check whether the cardholder has sufficient funds in his account to pay for the sale. If you consider a traditional situation, the POS (point of sale) machine at the business location takes the cardholder data, formats it, and sends it to Visa or MasterCard to see if the customer has sufficient funds. The card gets ¨declined¨ if there aren’t enough funds.

Online payments explained. Image credit: juliemoirmesservy.com

On the other hand, in an e-commerce transaction, the same process takes place online via a payment gateway. The payment gateway receives transaction requests, and then connects to Visa or any similar credit card company, and ultimately down the line to the customer’s card issuing bank to see if they have sufficient funds. If the customer has enough funds, the transaction is authorised and the funds are transferred from the cardholder’s account to the ¨merchant account¨. Often, a merchant account and payment gateway are set up in one process through the same company (i.e banks in Sri Lanka).

What you read above are the basics of how online payment processing works. Now, moving to the real problem: we mentioned how difficult and expensive it is to implement such an online payment gateway through a Sri Lankan bank. In such cases people can use alternatives. This is where the service of an aggregator comes into play. A good example is Paypal. Companies like PayPal have their own merchant account through which they facilitate multiple merchants . So in this case, you will not encounter the hassle of applying and setting up your own merchant account. Instead, your sales income will be pooled with many other merchants’ payments. Through such a method, the aggregator solves the issue for you. By pooling, the aggregator also loses the risk of getting affected by unpredictable businesses. (The aggregator does not ask about your credit situation like banks do, so they are taking a risk by offering you the service.)

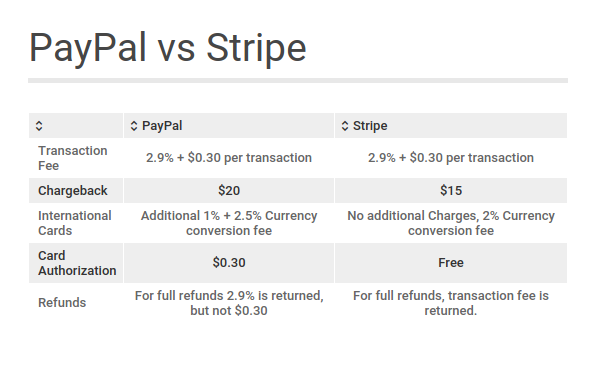

Paypal Vs. Stripe

Stripe or PayPal ‒ which one’s better? Image courtesy memberful.com

As of now, we don’t have an exact date as to when PayPal will allow inward remittance to Sri Lanka. Unless that happens, we won’t be able to utilise their payment gateway either. As an alternative, however, we might soon be able to use Stripe. But will it solve the issues at hand? How good is Stripe in comparison to PayPal?

To begin with, PayPal has been an immensely popular service to send and receive funds worldwide. Stripe, on the other hand, is a new player in the market, but has seen some rapid growth with investments from the founders of Paypal itself, as well as clients such as Facebook, Twitter, and Kickstarter.

PayPal has been more of a money transfer service between accounts. In other words, when you create a PayPal account and link your credit/debit card to PayPal, it becomes your secure payment method on the web. You can either use it as a method to pay for your online purchases, or you can directly send funds across PayPal accounts, by simply entering the receiver´s email address and authorising the transfer. For the merchant, PayPal lets you embed their payment processor on your sites to receive payments. Depending on the seller’s requirements, PayPal offers different solutions too, from directly accepting card payments (without requiring the customer to have a PayPal account), to checking out directly using the buyer’s PayPal account.

Stripe on the other hand is a simple, yet effective, payment gateway service. But Stripe also offers many other features found in PayPal, thanks to its developer tools. These APIs (application programming interfaces) allow developers to easily build on the basic Stripe framework. But the best part is that these additional features aren’t part of a separate service and fee scheme the way PayPal’s are. Unlike PayPal, with Stripe, you pay one flat rate for almost everything. Your options are only limited by the abilities of your developer. As a payment gateway, your customers get the option to simply enter their card details and make the payment securely, After which you receive the funds at your personal bank account, linked to your Stripe. Setting up and running Stripe on a website is so easy that they already have a huge following. (Note that PayPal also has been promoting a similar service of their own called Braintree).

Also, although Stripe has the feature that allows you to collect money on behalf of someone else and to send that money to a bank account using their API, it’s still only for US based banks.

Fees and Rates:

Yes, a payment processing service like Paypal or Stripe is super low cost compared to getting your own payment gateway through a bank. Setting up is usually free. But that doesn’t mean you don’t have to pay. Both companies have a payment structure, depending on where your business is located.

For PayPal, depending on where the services are offered (US or India or any other location), their charges differ. For example, the U.S fees start at 2.9% + $0.30 per transaction, whereas in India it starts at 4.4% + $0.30 per transaction when you want to sell online.

Currently, Stripe is available for businesses located in selected countries, including as private beta in a few of them. Their charges too start from 2.9% + $0.30 per transaction in the U.S, and it is 3.4% + $0.50 per transaction in Singapore, where the service is in private beta.

Stripe vs. Paypal- the basics.

User Experience:

Just after the announcement that Stripe will be available in Sri Lanka soon, we had a chat with Adnan Issadeen of Buffer, a social media management platform. Adnan has previously been part of one of Sri Lanka´s leading online marketplaces. According to him, Stripe´s simple interface and setup process easily wins over PayPal. With Stripe, you get to maintain the overall experience of your website without affecting any of your designs. It´s quite different with PayPal though. Most of PayPal’s solutions involve redirecting the user (buyer) to PayPal’s own site, then redirecting them back after authorising the payments. At the end of the day, these aspects may depend on individual preferences, but a simple, intuitive interface is always a good thing. Stripe also provides superior quality analytics for the merchants, compared to PayPal.

Setup Process:

According to Adnan, and many who have used both services, setting up PayPal is a lengthy, confusing process, that involves a lot of form filling online. On the other hand, setting up Stripe is a much simpler process that involves entering your email address and setting up a password.

He also pointed out that while Paypal offers recurring payments (such as subscriptions or rentals), compared to Stripe, it’s a hassle. With Stripe, you can actually store the credit card details using a hashed value that they give to you. Using this you can not only set up recurring payments, but if you are an e-commerce company, you can let people check out without ever having to see the payment gateway. Basically, with Stripe you get recurring payments that are easier, and you get on demand payments as well. You can even do pre-orders.

Additionally, Stripe´s terms and conditions are more transparent and simpler, compared to PayPal.

Data Portability:

Imagine you’ve been using PayPal subscriptions to manage a recurring membership fee from a number of customers. If you want to move to another payment processor (like Stripe), you can’t transfer that credit card data. PayPal doesn’t allow you to do it. You would end up asking your customers to sign up again and you’d probably lose some of them during the process.

Stripe on the other hand values data portability. If you decide to leave Stripe, they’ll help you migrate your credit card data in a secure way. This feature may not be useful to everyone, but it is still good to see companies taking it seriously.

Security

Both PayPal and Stripe are secure platforms. But what are the notable differences?

Stripe offers a killer feature through Stripe.js. When you use Stripe.js on your e-commerce website, the card details entered by your customers are never sent to your server. Instead, the data is sent directly to Stripe, securely. This is great in various ways. It is more secure since any security breach of your own servers will not affect customer´s credit card data. Also, such a process easily meets the PCI Compliance since you are not handling any sensitive data in your servers.

PayPal too offers an option to store cards securely, but it isn’t quite the same as Stripe.js. The sensitive card data still has to go through your servers, and this puts a big security burden on the developers and on the merchant.

Customer Support:

Customer support plays a vital part in user experience. PayPal has been in existence for more than 15 years, compared to Stripe which was founded in 2011. Both companies have various means through which customers can reach out for support. Reading through forums and user feedbacks of both services, it is quite evident that the support provided by PayPal is not so desireable. From the time taken to respond to customer complaints and getting the problem sorted, PayPal seems to be having a lot to improve on. Compared to PayPal, Stripe seems to be offering a pleasanter experience to customers, through active availability on social media and chat rooms.

Sri Lankan Perspective:

For years, Sri Lankan entrepreneurs and freelancers have not had the opportunity to receive funds or online payments in a convenient way. The main reason for this is that Paypal did not support inward remittances for Sri Lanka. There had been so many debates behind the reasons. PayPal officials were in Sri Lanka last month to discuss the same, but according to Sri Lankan officials, they have not yet decided on enabling Sri Lanka to receive payments; not until 2017 at least.

Of course, there had always been alternatives. There had been money transfer services like Western Union and Xoom, which have actually increased the transfer speeds a lot by partnering with local banks. But it has not always been a convenient option. Also, money transfers are of not much use for e-commerce sites looking for payment gateways. Another service 2checkout had been roving about as a sort of alternative. However their costs are higher than those of leading players, and they had only been providing standard wire transfers with some additional charges.

It is at this point that Minister Harin Fernando announced that they have met with Stripe executives and are working towards bringing Stripe services to Sri Lanka, as early as mid April. Given that we currently do not have a good solution for payment gateways locally, this is great news for Sri Lankan entrepreneurs, especially those who have plans to set up their own e-commerce sites. For those who are expecting easy money transfers online (like Paypal) for fund collections for charities, and freelance work, this may not mean much, even though they too have ways to use Stripe for the purpose. But as a payment gateway, Stripe has the potential to change the way e-commerce works in Sri Lanka.

This also means Sri Lankan banks will have to rethink their strategies of embracing the changes and supporting small industries, especially those who use the web as a medium to sell. From reconsidering charges, to improving security for their payment gateway offerings, there is a lot they will have to work on. Exciting times ahead!

Editor’s Note: The proposal to bring Stripe to Sri Lanka has already been submitted for the Central Bank’s approval, by the Minister and the Information and Communication Technology Agency (ICTA). An ETA should be available once the approval is granted. We have quoted Minister Harin Fernando saying that if there’s no delay on the part of the Central Bank, then we should see development within two to three weeks. Please also note that in a new market, Stripe usually launches as a private beta, before going open. So the public launch will depend on how fast the approval and paperwork are sorted.

If you found this article useful, and would like to learn more about what factors have been hindering e-commerce in Sri Lanka, do check out our article here.

Cover image credit: memberful.com