Recently, I overheard someone ask if they should make a payment in “cash, card, or crypto” — driving home the point that blockchain and cryptocurrency have become more than just a buzzword today, even in Sri Lanka.

In October 2021, the cabinet of ministers approved the establishment of a committee to study the feasibility of blockchain-related initiatives. In December, later that year, local media reported that the Colombo Port City would allow cryptocurrency trading, subject to some conditions.

With Sri Lanka recently branching out into crypto payments, NFT auctions, and crypto investments, I feel now is a good time to learn how the blockchain works — just so that — at the very least — we are able to get through a conversation without feeling too lost.

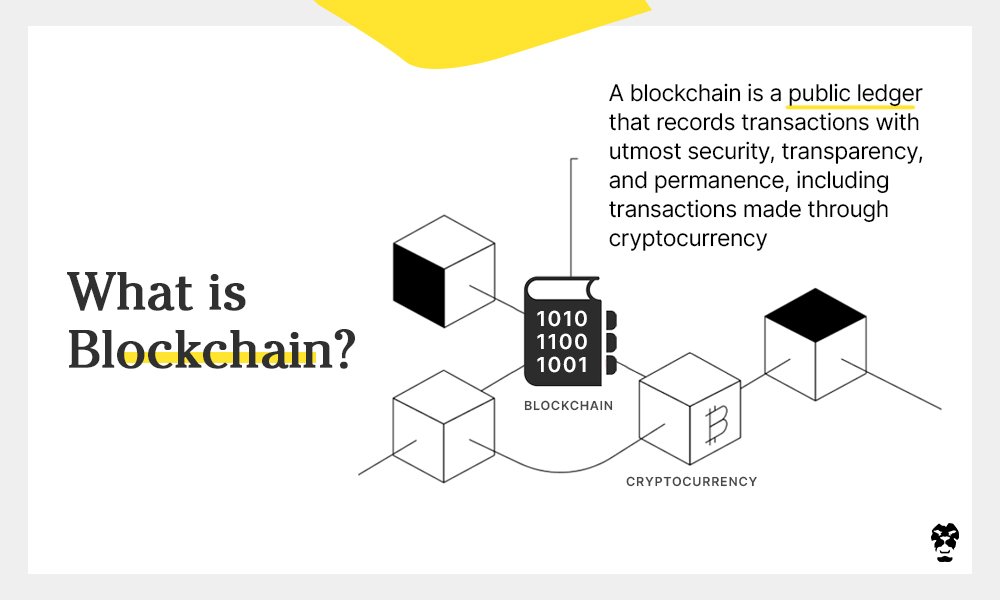

What is Blockchain…

We should start by understanding what blockchain, its signature product cryptocurrency, and its more recent sibling non-fungible tokens (NFTs) are. Simply put, a blockchain is a database (or ledger); its purpose is to keep (uneditable) records of any digital information, or more often, any crypto transactions.

A blockchain is publicly available and accessible, but there are a few features that set it apart from any other record-keeping method.

- It has no central authority, and thus, no single person/party upon whom verification depends.

- Instead of a central authority, miners (see below) verify individual transactions.

- Any records already present cannot be altered, preventing tampering.

- Each value in a transaction can only be transferred once, preventing data duplication or fraudulent transactions where the same item is sold to two or more parties at the same time.

Imagine a giant book sitting in the middle of a room in which very important transactions are recorded. But instead of one person in authority placing their signature to verify each transaction, all people in the room will — and as witnesses to the transaction, every person is equally responsible. Once you’ve inked the transaction, and everyone signs, the ink dries, and cannot be erased. And because everyone signs, and everyone is watching, no one is able to cheat or make the same transaction twice/sell the same thing to two people (double-spend).

In blockchain terms, each transaction is a block. And so the list of transactions becomes a blockchain. Blocks are not verified through a central authority, but through a large number of users, making manipulation next to impossible. Each of these people — known as miners (people who spend their time verifying transactions, and who receive crypto payments as rewards — has their own copy of the blockchain, making it further difficult to hack into and tamper with. And once a block is verified, it cannot be altered, unless every single block that came after it is reversed. On top of all that, since the chain is publicly available, all data is encrypted and therefore anonymous.

…And What Are Cryptocurrency And NFTs?

Cryptocurrency and NFTs are simply byproducts of blockchain. They both use blockchain as a base to ensure secure transactions for their own means. Cryptocurrency, according to Investopedia, is ‘a digital or virtual currency that is secured by cryptography.’ It adds: ‘Many cryptocurrencies are decentralised networks based on blockchain technology. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.’

Cryptocurrency initially garnered interest as a trade-for-profit venture, with stock market-like interest driving transactions. More popular platforms, like the famous Bitcoin, sometimes experience massive spikes in worth because of these investments.

NFTs also use the blockchain, but not for currency. In this instance, the value recorded is something akin to a copyright, which one can use the blockchain to trade or sell. This particular use of the blockchain is designed in such a way that there can be no duplicates and is a game changer for all those digital artists out there who had no way to sell rights to their virtual work all this time.

The catch with NFTs is that you can own the rights to anything that is virtual — the most obvious being digital art. However, there have also been some… less conventional and slightly… confusing transactions taking place through NFTs as well, including rights to a tweet, gifs, memes, a virtual perfume, and last but definitely not least crazy, an invisible sculpture that does not actually exist. Confusing? Yes it is. But on the plus side, if you think your MS paint doodle is worth anything, you might be able to sell it now!

Blockchain Technologies In Sri Lanka

As with any new (or relatively new) technology, users and entrepreneurs adapt fast, and the same holds true with blockchain technologies. Many companies in Sri Lanka are now adopting blockchain technologies and even cryptocurrency payments.

Seyln Exporters, a popular local handloom and handicrafts company, is one of the companies adopting blockchain. The company says that in doing so, it hopes to give customers a verified and secure method of learning more about the products they’re buying. “Blockchain technology ensures that each point in the production process is recorded so that consumers can access independently verified, real-time, detailed metadata of what they want to know,” the company’s head of Business Development, Selyna Peiris said in a recent statement.

Another company enabling cryptocurrency payments is online retail giant Kapruka. Founder Dulith Herath believes that enabling cryptocurrency is much easier than we make it out to be: “Many think it’s a big deal to accept cryptocurrencies for a business. It’s not. In fact, it’s easier to integrate a cryptocurrency gateway to your e-business than to integrate a credit card payment gateway,” he told Roar Media.

On the NFT side of things, although most people are still somewhat confused about how that works, Sri Lanka successfully held its first NFT auction last year, generating over USD 2,000 for local artists. Sigiriya, the highest priced digital artwork of the day, sold for USD 1,275.

The Legalities Around Crypto In Sri Lanka

However, despite the many possibilities it poses, there’s a legal quagmire concerning crypto. The same decentralisation that worked in blockchain’s favour also means that governments are wary about endorsing cryptocurrency. The lack of a central authority makes it harder to manipulate, but also harder to blindly trust.

The Central Bank of Sri Lanka (CBSL), for this reason, has stated that any crypto investors entering the virtual currency world are on their own. “The public is also informed that CBSL has not given any licence or authorisation to any entity or company to operate schemes involving VCs, including cryptocurrencies, and has not authorised any ICOs, mining operations, or Virtual Currency Exchanges,” the bank noted in a communique dated 9 April 2021. In October the same year, CBSL Governor Ajith Nivard Cabraal reiterated this sentiment at a press briefing.

However, the CBSL’s reluctance only seems to extend to virtual currencies and not blockchain itself; just a month after it issued the statement, the CBSL shortlisted three banks to create a proof-of-concept for a shared “Know Your Customer” facility using blockchain. A report on this was presented to the Governor on 25 October. And on 6 October 2021, State Minister of Digital Technology Namal Rajapaksa, via Twitter announced that Cabinet approval had been granted to establish a committee to propose policy on blockchain technology, digital banking, and crypto mining.

Looking To Our Neighbours

Addressing a webinar in August 2021, Sanjay Mendis, who founded Bitcoins.lk to help Sri Lankans understand what cryptocurrency is all about, observed “Cryptocurrency is dominated by Asia, not the West.” Recent reports by Chainalysis, a blockchain data platform, also showed a 706% increase in cryptocurrency transaction activity in Central and Southern Asia and Oceania from July 2020 to June 2021, with USD 572.5 billion in value received during this period, representing 14% of global transaction value during.

Despite this, our immediate neighbour India decided, on 23 November 2021, to present a law to ban private cryptocurrencies and create a framework for a central bank-backed digital currency — a move that surprised many. The decision seemingly followed Indian Prime Minister Narendra Modi’s dire warning that Bitcoin is a risk to the younger generations.

Two months earlier, another regional powerhouse, China, also decided to declare all cryptocurrency transactions illegal, which came as a blow to the international community, as China was a key stakeholder in the Bitcoin market. The price of Bitcoin fell by more than USD 2,000 (GBP 1,460) in the wake of the announcement.

Over in the Western Hemisphere, acceptance of crypto and blockchain seems to be higher. In fact, Canada recently launched a crypto ETF system, and in September, El Salvador became the first country to use Bitcoin as legal tender alongside the US dollar. While it can be regarded as a step towards a more digital future, the move also led to large-scale protests over fears cryptocurrency would bring instability and inflation to the country, with even the Governor of the Bank of England raising concerns. In the UK, cryptocurrency is considered property but not legal tender. Additionally, cryptocurrency exchanges must register with the UK Financial Conduct Authority (FCA), which has banned the sale of crypto derivatives.

In coin-clusion

As things stand, the Sri Lankan government seems to be exploring blockchain technology, digital banking, and crypto mining, but cryptocurrencies seem to be divided by a very fine line and deemed ‘unacceptable’, at least for now.

This distinction, as well as the CBSL’s staunch stance that virtual currencies are unregulated, has led to the popular misconception that cryptocurrencies are illegal. However, at present, it is simply in a grey area; it is fully legal, but unregulated, and those who delve into it have to do so with no legal backing, and at their own risk.

Whether that status will change in the future remains to be seen. While the government, the younger generation, and the majority of entrepreneurs and corporations seem eager to explore the idea, the CBSL remains unmoved. And against a backdrop in which two of Sri Lanka’s closest allies, India and China have both decided to shun the technology, the question is whether we will also inevitably follow the same path.

.jpg?w=600)

.jpg?w=600)