All of us have that one friend who is addicted to buying stuff off eBay and Amazon. Every once in a while, we all have found him/her complaining about the exchange rate. There are also quite a few among us who still multiply a given dollar amount by 100, and then quickly realise that a dollar now goes for 146 rupees. Such occurrences are also accompanied by grumbles of “The economy these days… what to do aney! ”

So we decided to have a look at what’s going on with our currency’s exchange rate.

But first of all, what is an exchange rate? Simply put, the exchange rate is the price at which one country’s currency can be exchanged for another.

In the modern world, this “price” is driven by the factors given below:

- Differences in Inflation Rates between countries,

- Differences in Interest Rates between countries,

- Trade and Current account balances (Balance of Payments),

- Short term capital flows / Equity flows,

- Relative economic performance & productivity of the economy,

- Public debt levels & external debt servicing commitments,

- Other factors such as domestic political turmoil, market speculation etc.

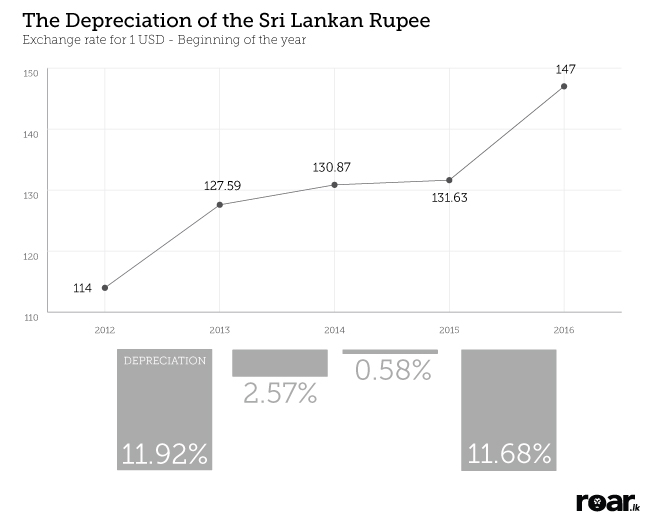

Exchange rates stated are 1 week averages. 12 months ending December 31st.

Something worth remembering here is that speculative activity, short term capital flows, and domestic political turmoil usually tend to have a short term effect on the exchange rate. Over the long run however, the structural issues of the economy will start to affect the exchange rate. And this is precisely where the rupee’s exchange rate woes begin.

According to many Economists and independent observers, unsound economic policies and loose fiscal management by policy makers are the root causes of our problems.

But should we be worried? Well, yes. A severe weakening of a country’s currency can erode the living standards of its citizens, especially the poor. How? Well, it’s like this. A weakening rupee will diminish our ability to import things we need such as food, medicines, machines, and even smartphones. So basically, imports will become more expensive. And this will also affect our exports because we need to import stuff like machines and raw materials in order to manufacture whatever we export. This phenomenon is one of the reasons why BOTH imports and exports go hand in hand with a healthy and vibrant economy. Most competitive, export oriented economies realised this a long time ago, which is why their economic policies normally focus on maintaining a stable exchange rate.

So what should we be doing to put the rupee out of its misery?

Time for a cleanup? Image Credit: The Republic Square

We asked W.A Wijewardena, an economist and a former Deputy Governor of the Central Bank, about this matter. And this is what he had to say…

On why the rupee is where it is today:

“The current forex crisis is very critical for Sri Lanka and it is not the handiwork of the present Government. The seeds of the crisis were sown as far back as 2012, when Sri Lanka downplayed the export sector as a wealth creator and instead concentrated on developing a ‘domestic economy based’ system.

Thus, the Export-to-GDP ratio started falling from around 30% in 2000 to less than 15% in 2014; it is still lower in 2015. At the same time, imports ballooned and remained at a high level, increasing the trade deficit to unaffordable levels. The authorities relied on remittances to fill the gap but it was not sufficient, and the country ended up with a deficit in the current account of the Balance of Payments. It was filled by borrowing from abroad which increased the country’s foreign indebtedness (to commercial sources). That, plus the move towards domestic income creation further exacerbated the crisis, and now it is uncontrollable.

This Government too committed a sin by failing to disclose the crisis to the people, and by signing off on the wrong economic data published by the previous Government. Now, they can’t defend the exchange rate without driving the country to bankruptcy. Foreign loan servicing liabilities in the next 12 month period amount to $ 5 billion; other short term liabilities such as Swap arrangements with local banks, India and China exceed $ 3 billion. But, the available reserves are just $ 7 billion.

On how to fix this issue:

A two-way approach is needed to resolve this issue:

- By going for an urgent stand-by arrangement from the IMF in order to build confidence among foreign investors.

- By introducing a massive export oriented restructuring of the economy to avert the crisis in the long run.” *

* Mr. Wijewardena emphasises the need to pursue both solutions. Meanwhile, the need to restructure the economy was also endorsed at the recently concluded Sri Lanka Economic Forum.

Notice how the decline in the Export-to-GDP ratio has happened over a long period of time (~15 years, to be exact)? What that points to is an underlying structural weakness in the export sector of our economy. Also notice how we have had to rely on foreign remittances and borrowings to plug our trade deficit. Add to this mix the unsound economic policies that we’ve pursued, and you arrive at our current economic problems.

So what do we do now?

Well, it’s our policy makers who have to do the bulk of the work to help turn the economy around. What we ought to do as a country, is to push our policy makers towards fixing these issues instead of arguing amongst ourselves. Because in the long run, none of our quibbles will matter if the economy crashes. And fix the economy we must, since our future depends on it.