‘Devika’ is a street cleaner. Clad in an orange-coloured t-shirt, she is a foot soldier in the small army employed by a big conglomerate to clean up after around 647,000 citizens. They work night and day, in the merciless heat and the unforgiving monsoon, keeping our streets and neighbourhoods clean.

In this sprawling Megapolis-to-be, there is a shop front where homeless Devika and her husband sleep every night. She survives on a daily wage of Rs. 550, which comes to about Rs. 16,500, if she works for an entire month. The largest chunk of her salary goes towards purchasing food. Given the food price hikes, she now spends a minimum of Rs. 300 a day on food that is far from nutritious and satiating. When Devika gets sick, she earns less and skimps on food. According to the latest globally accepted poverty line of USD 1.90 a day, Devika is not considered poor, as she lives on roughly USD 4 a day. She is also not counted as “poor” according to Sri Lanka’s National Poverty Line, which estimates “the poor” as individuals living under Rs. 4,063 per month (Rs. 135 a day for food and non-food expenditure), which excludes her from state-sponsored social security measures such as Samurdhi.

In a world infected by thoughtless consumerism, the labour of Colombo’s street cleaners is vital to the health and safety of our neighbourhoods. Street cleaners like Devika are part of a large universe of informal workers, which includes marginal and small farmers and agricultural labourers, fishing labourers, street-vendors, domestic workers, and other home-based workers in a range of industries, casual workers in construction, manufacturing, retail trade, and so on. Together they form 68% of our labour force, and are constantly struggling for livelihood security.

On the cusp of Sri Lanka’s transition into a third republican era with transitional justice and constitutional reform processes progressing in parallel, it is important that we ensure that socio-economic rights of a vast majority of workers in the country are given priority.

Social Security In The Sri Lankan Context

Street cleaners are among those who belong to the vast informal sector, made up of workers who are constantly struggling for livelihood security. Image credit: Roar.lk/Malaka Pathmalal

Abram de Swaan identified two generic concerns driving humanity’s quest for social security – deficiency and adversity. The former refers to inadequacy of means for a minimum standard of life, while the latter refers to contingencies such as sickness or accidents, and eventualities such as old age and death.

P. Kannan (2007) attempted to address these two concerns by introducing Basic Social Security (BSS) and Contingent Social Security (CSS). BSS is directly associated with the problem of deficiency among workers, who are not in a position to access minimum resources to meet their economic and social requirements for a dignified life in a society. CSS is linked to social arrangements to take care of adversity. Workers like Devika have neither form of social security.

Social security is typically conceived as protection provided by the state to its citizens against providential mishaps over which a citizen has no control. The underlying philosophy is that the state ensures a minimum level of welfare that covers major contingencies of life. The conceptualisation of social security advanced in this article stemmed from the realisation that state action based on the conventional way of thinking about social security would not suffice for the poor in the informal sector. Sri Lanka’s dominant economic vision and trajectory in the context of globalisation is characterised by quick mobility of capital, and it has worsened the vulnerability of the workers, especially those of the informal kind. Hence, social security in countries like ours will have to be viewed as part of, and fully integrated with, anti-poverty policies such as food security and employment guarantee.

Who Makes Up The Informal Sector?

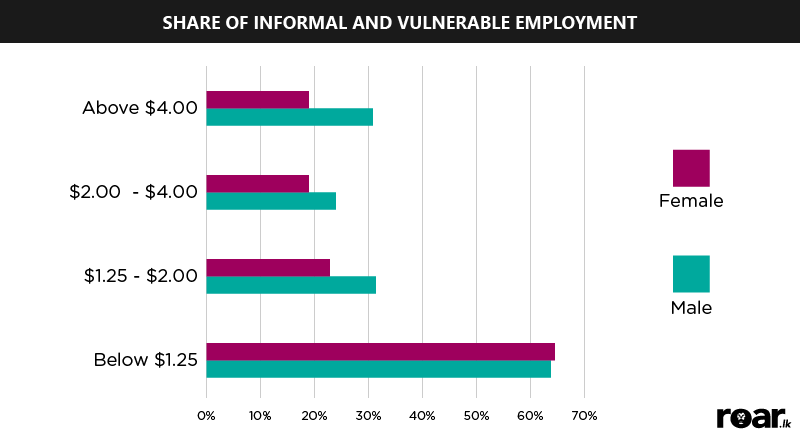

As one can see from the graph below, nearly 65% of people living below the previous international poverty line in Sri Lanka engage in informal and vulnerable employment. If the new international poverty line (USD 1.90) is considered here, the proportion of workers engaging in informal and vulnerable employment would increase even more. There are more poor women than men who engage in informal work. Workers in the poorest category are largely comprised of casual wage employees. Their resource base is very poor and they also lack skills and education in order to adjust to the changing nature of employment and work conditions.

Share of informal and vulnerable employment in total employed population aged 15+, by sex and economic class

Source: Gunasekara, Vagisha. 2015. “Unpacking the Middle: a Class-based Analysis of the Labour Market in Sri Lanka.” Southern Voice. Occasional Paper 22.

There is also a close correspondence between informal employment, poverty, and vulnerability and social status. Predictably, people from lower castes are sedimented in the bottom rungs of the informal labour market. The grim picture portrayed by the above figure would only worsen if the large Indian Tamil population in Sri Lanka who mainly work in tea plantations is also counted in the informal labour force.

As Economist Priyanka Jayawardena points out, although considered “formal employment,” the jobs of estate workers are far from decent – their remuneration is insufficient to cover basic expenditures, hence these workers are among the country’s poorest with 61% of estate sector households falling into the poorest category in terms of socio-economic status.

Given this scenario, the world of work in Sri Lanka is characterised by the absence of social security for an overwhelming majority of workers. Such a picture has to be seen along with the existence of statutorily provided social security for the formal workers in the formal sector to cover a wide range of contingencies and eventualities.

Social Security In The Unorganised Or Informal Sector

Sri Lanka is yet to develop a comprehensive national social security policy for its entire working population. Every successive government in the post-colonial history of our country has failed to ensure the security of over 65% of those who contribute to our economy. Hence, there is the need for a multi-tiered policy framework that combines basic and contingent social security.

First, there is the need for a universal programme for human development and security. While Sri Lanka currently has universal programmes for education and healthcare, the privatisation of both these services in the aftermath of the 1977 liberalisation reforms has translated into poor access and quality of education and healthcare for the poor. The poor are affected the most by the significantly low public investment in education and health care. The proposition here is to strengthen the system of providing free education and health care to all citizens of this country by investing in financial and human resources in both sectors.

The second tier of a national social security policy must be to ensure BSS for all poor citizens. This means that food, nutrition, employment, and housing security, funded by the public exchequer, must be guaranteed for the poor. Many scholars (i.e. Dev 2001) have advocated the need for a combination of these two types of social security backed by empirical evidence on the nature and dimensions of poverty and insecurity. India has an impressive list of schemes that are in operation, out of which the National Rural Employment Guarantee (NREGP) is a relatively recent development.

The third tier must be to ensure CSS to all working poor. The state of Kerala in India was a pioneer in adopting policies such as the Building and Other Construction workers (regulation of Employment and Conditions of Service) Act in 1996, ensuring social security benefits to meet contingencies such as accidents, old age, housing loans, insurance premiums, children’s education, medical and maternity benefits. The Welfare Fund Model adopted by Kerala, a state which has a fairly long history of labour movements, now includes all workers that belong to the unorganised sector.

Social Security, Not A Charity Measure

Social security for workers in the informal sector must be viewed as part of their social contract with the state. Image courtesy shutterstock

It must be borne in mind that social security, whether of BSS or CSS kind, for the working poor should not be construed as a charity measure. The informal sector contributes to a significant proportion of the GDP of Sri Lanka, hence, adequate social security for workers in the informal sector must be viewed as part of their social contract with the state.

A comprehensive national social security policy for workers in the informal and unorganised sector must be supplemented with legislation addressing conditions of work, and minimum living wage. The provision of minimum conditions of work (such as work hours, safety standards, availability of drinking water, etc.) needs to be viewed as complementary to the provisioning of contingent social security because much of the insecurities (especially health) are reinforced by poor working conditions.

The fourth component of security-oriented work in the Sri Lankan context is the need for ensuring the payment of a minimum living wage. Although the concept of minimum wage has been accepted for quite some time, the current monthly rate of Rs. 10,000 and a daily rate of Rs. 400 (National Minimum Wage of Workers Act), is hopelessly insufficient. In fact, the International Wage Indicator and its local partner Salary.lk (2015) estimates that the living wage for an individual should be at least Rs. 29,600/month, and Rs. 67,800 for a family in Sri Lanka. A recalibration of the current minimum wage structure is urgent, and it is imperative to link this exercise to the revising of the poverty line. National poverty lines are typically estimated based on how much it would cost an individual to buy enough calories (food) and other things (i.e. medicine, transport, etc. also known as non-food consumables) required to sustain themselves on a daily basis. In other words, the standard assumption when constructing poverty lines is that it pegs caloric requirements to the basal metabolic rate, which broadly corresponds to a passive physical state without any undue expenditure of energy in work. The basal metabolic rate is the rate at which a given human body uses energy while at rest to maintain vital functions such as breathing and keeping a balanced body temperature. Does our current poverty line adequately account for the energy needs of the kind of hard and extended labour that is performed by informal workers? The vast majority of informal workers in our country certainly do more than just breath during their work shifts.

Such questions and others should be discussed publicly in a consultative process of formulating a minimum living wage and revising the official poverty line. An example from the garment sector is the Asia Floor Wage Alliance Worker Tribunals, which give workers in the region an opportunity to share their experience and speak with government and brand representatives on issues of poverty and wages. Though these tribunals have taken place in Sri Lanka in 2014, they appear to have taken place in a silo, de-linked from any public discussion on living wages and poverty lines for all workers.

The National Commission for Enterprises in the Unorganised Sector (NCEUS) in India called for a “social floor” consisting of three measures: a national minimum social security, minimum conditions of work and a national minimum wage, along with provisioning of BSS. In the context of Sri Lanka, the concept of a social floor should be altered to include the 4-tiered national social security policy that combines universal coverage of health and education, basic and contingent social security and a national minimum living wage. Such a social floor would undoubtedly reduce poverty and also stimulate growth and development through its effects on improving health and education and livelihood security.

Featured image credit Roar.lk/Malaka Pathmalal