As part of the policy towards tax simplification, and the setting of a legal framework to modernize tax systems to help taxpayers understand the system, while eliminating loopholes that have created ambiguities in the law, the Inland Revenue Act No. 24 of 2017 has been enacted and it will be operative from the 1st of April 2018.

Here are ten things you need to know about the new tax law

1. Taxation of individuals

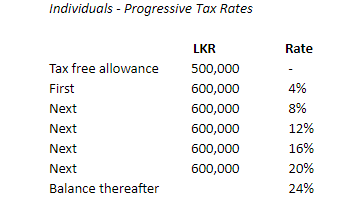

Sri Lankan citizens and/or tax residents will continue to be entitled to a tax-free allowance of LKR 500,000. This means that you only need to pay tax if you have an income in excess of the threshold. The excess will be taxed at the progressive tax rates tabulated below:

In addition to the LKR 500,000, employees were afforded a further concession of LKR 250,000. The new law increases this additional allowance to LKR 700,000. This means that those in employment will be able to earn a tax-free all-inclusive salary of LKR 1.2 million a year (so that’s basically an LKR 100,000 a month free of tax). At present, the maximum tax rate on employment income is 16%—the new law removes this cap, and therefore employees will fall in line with the standard progressive tax slabs shown above.

As in the past, the employer will be required to deduct the tax prior to paying the remuneration.

2. Taxation of employees

In addition to the LKR 500,000, employees were afforded a further concession of LKR 250,000. The new law increases this additional allowance to LKR 700,000. This means that those in employment will be able to earn a tax-free all-inclusive salary of LKR 1.2 million a year (so that’s basically an LKR 100,000 a month free of tax). At present, the maximum tax rate on employment income is 16%—the new law removes this cap, and therefore employees will fall in line with the standard progressive tax slabs shown above.

As in the past, the employer will be required to deduct the tax prior to paying the remuneration.

3. Interest exemption for senior citizens

Senior citizens (i.e. those who are 60 years and above) will be able to enjoy tax-free interest income up to a maximum of LKR 1.5 Million per year.

4. Taxation of Partnerships

A Partnership is not liable to pay income tax on its Taxable Income. Instead, a withholding tax of 8% will be deducted from the share of any partnership income at the time the profits are distributed to the partners.

5. Taxation of trusts and charitable institutions

The 10% tax rate for non-corporate entities such as Charitable Institutions, Employee Trust Funds, Provident or Pension Funds, and Termination Funds has been increased to 14%, while the taxation on unit trusts have been revamped.

6. Tax deductions at source

The current tax deductions at source (Withholding Tax or “WHT”) have been revamped. Under this scheme, the payer has to deduct tax at certain rates on certain payments, a few examples of which are set out below:

- WHT on interest paid to individuals, currently at 2.5%, will be doubled to 5% on bank deposits. The interest that has suffered the WHT will not be liable to further tax in the hands of the depositor.

- Notional tax on government securities has been removed. However, in this instance, it leaves room for the individuals to be taxed as per the progressive tax tables on such interest income since there will be no deduction at source.

- WHT on interest paid to companies currently at 10% will be reduced to 5%. The tax deducted can be claimed as a credit by the company.

- WHT on dividends currently at 10% will be increased to 14%.

- WHT on certain service payments (in excess of LKR 50,000 per month) has been introduced at 5%.

- WHT on rent has been introduced at 10%.

- WHT on cross-border payments has been revised.

7. Taxation of companies

Corporate Tax rates have been revised under a three-tier structure at a lower rate of 14%, standard rate of 28%, and higher rate of 40%. The lower rate of 14% is afforded for companies who are SMEs or are engaged in export of goods and services, agriculture, education or IT. The higher rate of 40% would continue for those engaged in the business of liquor, tobacco and betting and gaming.

8. Tax Losses

Currently, tax losses have an indefinite lifetime. The new law restricts the carryforward period of unutilized tax losses to 6 years. Furthermore, losses are deductible only against business profits from the same activity/tax rate.

9. Removal of tax exemptions

The new law has removed various source-based and institutional exemptions. However, in keeping in line with investment promotion, concessions for investments in new business undertakings can be obtained via enhanced depreciation allowances, depending on the quantum of the investment and the province in which the investment is made. In the instance a tax loss arises due to enhanced depreciation allowances claimed during a year, the losses can be carried forward up to 25 years.

10. Introduction of Capital Gains Tax

A key change in the new law is the introduction of taxation on “gains on realization of investment assets/liabilities”, loosely referred to as “capital gains tax”. The tax will apply to any person (individual or otherwise) on gains from the sale of investment assets. Gains are calculated as the excess of the consideration over the cost of an investment asset. The rate of tax applicable on gains from the realization of investment assets is 10%. Tax is to be paid on gains from realization of investment assets within one month after the realization of such assets.

Cover image courtesy truebluela.com