Once embroiled in a fiery civil war which enshrouded its trade, performance, and pithy picturesqueness, Sri Lanka has since emerged from the conflict-driven tumult and is making a fresh appearance on the global stage. Shedding a tempestuous past, the country is moving forward into an auspicious future modulated by socioeconomic reconciliation, reconstruction, and recoupment.

Presently, the commercial marketplace is characteristically awash with resolute entrepreneurs stepping into the startup eco-system of the country, collectively driven by a productive eagerness to carve out a commercial niche and get a head-start on the road to success. From clever FMCG retailers to artisanal F&B eateries, chic fashionistas, handy crafters, and whizzy tech companies, glaringly innovative small businesses are all the vogue.

If you’re thinking of kick-starting your own small business, you ought to know that starting up in Sri Lanka is not a daunting task. In this article, we attempt to answer some of the questions that you might have regarding the start-up process, while at the same time assaying to avoid sounding too much like a chartered accountancy hand-out with our business speak. So hearken up ye future businesspersons, and take a gander at what we’ve spun out below.

Firstly, Why Should I Register My Business?

Registering your company galvanises your business proposition with a layer of authenticity from which certain benefits flow, including:

- The possibility of opening a bank account or opting for bank facilities for business requirements;

- The ability to bid for tenders and register yourself as a supplier of products or services — especially with SMEs, large enterprises, and listed companies;

- Imparting a professional outlook to your intended operations — easier to brand and market your products/services, attract talent, etc.;

- A guarantee of protection for your unique business name — which may be a key propellant of your marketing drive; and,

- Limiting your personal liability— albeit only in the case of a company (discussed below).

Okay, So What Business Structure Can I Adopt?

Well, there is absolutely—[enter iniquitous feline-flaying locution]—more than one way to skin this cat.

You can certainly endeavour to structure your business in several distinct ways. Three main types of business structures adopted by small businesses in Sri Lanka are: (a) sole-proprietorships; (b) partnerships; and (c) private companies.

Business structures

As a registered sole trader, you and the business will be considered one and the same from both a tax and legal perspective, even to the extent where you are held personally responsible for the actions of the business, including the repayment of any debts it incurs. Disregarding this impediment of unlimited liability, a sole proprietorship business structure is easy to set-up, commands less paperwork and reporting covenants, and is taxed at a personal income tax rate. Like other structures, as a sole trader you can employ people to help you run your business.

A registered partnership can also avail the same benefits and drawbacks as above. A partnership business is not considered a separate legal entity from a legal and taxation perspective and hence carries unlimited liability. However, one of the key differences is that this time, the pie of responsibility is sliced among the partners to the business in line with the provisions made within the ‘partnership agreement’ (i.e. usually on a pro-rata basis where applicable).

In contrast to the above, forming a registered company limits your external exposure by separating you from your company in the eyes of external institutions. It separates your personal identity, and therefore your obligations, from that of the business entity. However, companies are governed and controlled by the Companies Act and are subject to rules and regulations laid out by the Registrar of Companies, the Securities and Exchange Commission, and the Sri Lanka Accounting Standards.

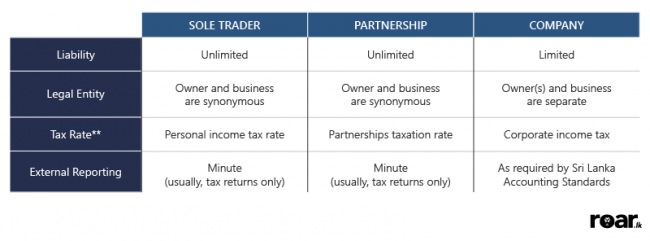

The following table summarises the main features inherent to each structure:

Main features of each business structure

** It should be noted that personal income tax rate is presently on par with the standard corporate tax rate of 15%. However, per recent policy proposals forwarded by the Sri Lankan Premier, the standard tax rate of 15% may be temporarily abandoned and the preceding tax regime (i.e. of FY 2014/15) adopted.

Should this be the case, the former graduated tax schedule shall apply (personal income tax between 4-24%; and corporate income tax between 12-28%, excluding those dealing in vices).

Caveat emptor! We’re no experts in tax so do not take our word for it.

Got It. So, Is It Hard To Set-up A ‘Company’?

Absolutely not! Establishing a company is an easy task which is best undertaken with adequate capital and soldered with a dash of effort and a dollop of commitment. The underlying procedures inherent to the start-up process have considerably improved owing to the persistent lobbying efforts of the business community and various industry institutions/curators, as well as conducive steps taken by the national administration.

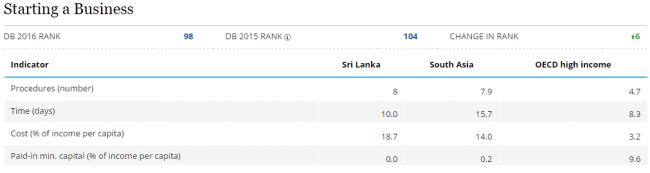

A recent report compiled by the World Bank Group, too, indicates an improvement in Sri Lanka’s ranking as a potential destination to do business, having ascended 6 places to the 107th spot out of 189 in the ‘Doing Business Index’ for the year 2016. Accordingly, the start-up process in Sri Lanka now features only nine pertinent steps, all of which take ten days (on average) to complete.

Source: The World Bank

(For the purpose of simplicity, we will assume that you intend to start a business that: (1) is 100% locally owned; (2) is into general commercial or industrial activities; (3) is not a BOI project; and (4) does not directly engage in import or export activities.)

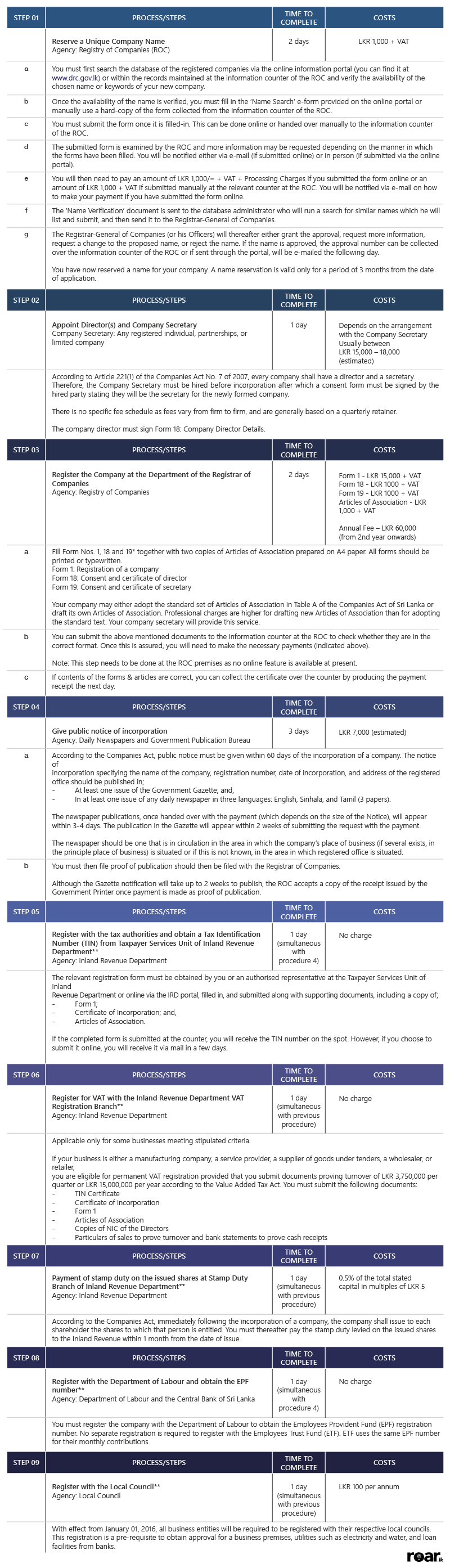

The first eight steps are: (1) reserving a name; (2) appointing directors and a company secretary; (3) registering with the Registrar of Companies; (4) giving public notice of incorporation; (5) registering with the tax authorities; (6) registering for VAT; (7) payment of stamp duties; and (8) registering with the labour department.

Additionally, with effect from January 01, 2016, you must also register your business with the respective local council at a nominal fee and this would function as a prerequisite to obtaining electricity, water, and bank facilities. We will introduce this as step (9). (No doubt the World Bank report will reflect this step in their next circular!)

Your company is now ready to do business!

(Note: we will visit the steps that apply when registering as a sole proprietor or partnership, which are much simpler, at a later time.)

Cool, But I Want More Details On How To Start My Company

Sure thing. Here you go:

How To Start Your Company: the processes/steps involved.

* Forms can be found here (or you can scroll down to the bottom of this article if you want to know what they look like)

**Can take place simultaneously with another process

Closing Thoughts

Starting up a business may seem like a daunting task, but with the right drive and the necessary resources, you should be able to have it up and running. Image credit bigstockphoto.com

Nearly eight years since earning its peace dividend, the economy has certainly sprung into growth mode. Doubtless, there will be factors — some internal and some external to the local economy — that will mar the momentum of the development drive along the way. Nonetheless, we’re confident that through relentless effort, reforms, and adaptive spirit, Sri Lankan industries will persevere. Study the market, pick a niche, aim to excel, and make your investment today.

We hope you found this article insightful. Leave us your comments, thoughts, suggestions for improvement, and any ideas for more business-related content below.

Further Resources

The detailed registration process can be found here (we encourage you to read it lest it is revised):

http://www.drc.gov.lk/app/comreg.nsf/eb209294bae3f1a0462573f4001cad99?OpenForm

These are the forms you’ll need to fill in during the process:

The following document, released by the Central Bank of Sri Lanka, also provides a wealth of useful information and even stems into discussing salient factors relating to operational matters such as obtaining electricity, water, construction permits, land approvals, contracts, etc.

http://www.cbsl.gov.lk/pics_n_docs/10_pub/_docs/pa/other/dbsl.pdf

The tax schedule applicable to individuals, partnerships, and companies can be found here:

http://www.ird.gov.lk/en/publications/SitePages/Tax%20Chart.aspx?menuid=1404

Cover image credit: bigstockphoto.com

[foogallery id=”7729″]