Equity crowdfunding is a seamless model in the West thanks to better regulation, legal protections, and the general maturity of the ecosystem. In Sri Lanka, half a world away, CrowdIsland has embarked on a similar model, albeit with a few tweaks mandated by the excellent teacher that is experience.

Sri Lanka’s young, nascent startup ecosystem in only just learning about how to successfully take a product from idea to reality, sans the comfortable financial cushion available to giant corporates. It requires these startups to think big with a fraction of the resources available to even a mid-sized corporate in the country. It is a new way of commercialising innovation, and a largely uncharted path to success, in the Sri Lankan context. And the difference between success and failure comes down to execution, which, to be honest, is not something that can be easily taught, and funding, which is not so easily found. At the intersection is where CrowdIsland has now chosen to position itself.

Initially conceived as a platform to enable equity crowdfunding, it didn’t take long for the founding team to realise that the model, in its purest form, will not work in a market like Sri Lanka. Armed with that realisation, and subsequent to around six so-called ‘pivots’ in startup parlance, CrowdIsland today works somewhat similar to a hybrid of a traditional venture capital firm and a crowdfunding platform, guiding and helping budding entrepreneurs to attract investors. Essentially, CrowdIsland’s mission is to help startups become ‘Investor Ready’.

We spoke to CrowdIsland’s Chief Executive Chalinda Abeykoon to find out what goes on ‘under the hood’. Here are some excerpts from the interview:

What is CrowdIsland (CI) and how did it start?

The entire idea was first hatched in February 2016, and back then, all we wanted to do was create a platform to enable equity crowdfunding for seed stage startups in Sri Lanka, with a little bit of inspiration from peers like Seedrs and Kickstarter. I joined CI in July, prior to which I was heading the corporate startup accelerator of a prominent local apparel manufacturer. As we started building on our initial idea, we saw that startups coming to us needed help with formulating their campaigns, and that was a pain point. There was a gap between the information generally requested by investors, and the information supplied by the entrepreneurs themselves. The whole reason for that was the completely different backgrounds the two parties came from. The entrepreneurs behind most of these startups are usually ‘techies’ and while they know their tech very well, they might not be so familiar with general business vocabulary. On the other hand, investors think about businesses in a completely different way, and they have their own inner compass and knowledge frameworks to guide them, which means they interpret things differently. This is the so-called ‘gap’ between the two parties, which we realised was the second pain point.

That was the turning point for us when we realised that a pure equity crowdfunding model would be too premature to implement here. Thus came our pivot – the first of many.

Thanks to those shifts in our strategy, we are where we are today. Now, when a startup comes to us, we filter them based on a few metrics to identify whether they are ready to receive external funding. If they are, we guide them through our trademark process of ‘Becoming Investor Ready’, and help them with practically all aspects of raising money. That includes identifying KPIs, deal-structuring, and the like. It used to take us around five months to take a startup through this process, but now we can do it in two. So, I guess we have also become better at it and learned a few things along the way.

Do you think it’s a better approach?

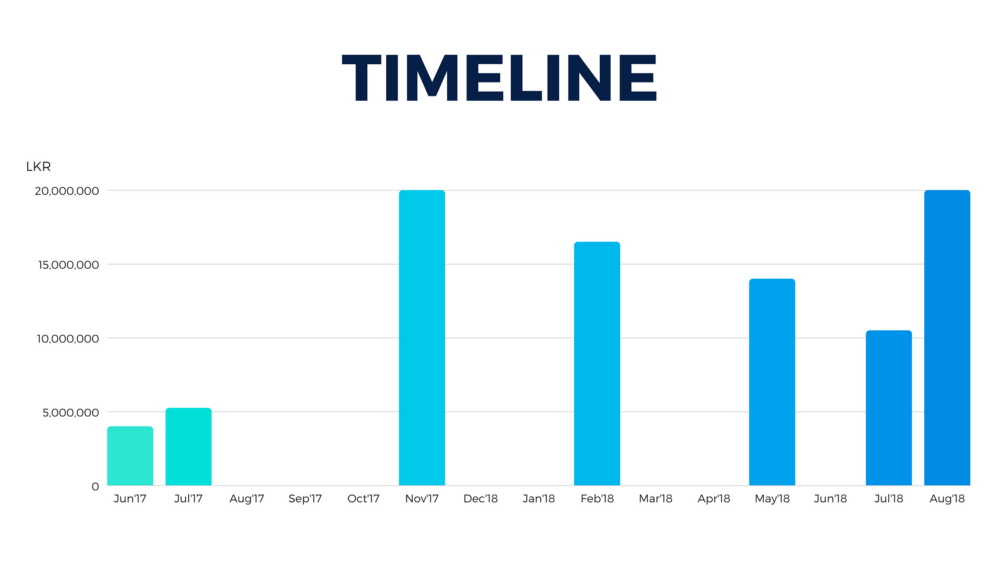

In certain ways, yes. Back then, our own internal KPI was how much we’ve helped raise,but that’s not a good yardstick as it’s misleading. You see, it’s not about the quantum of funds raised. What matters is that a startup should be able to take the money they raise and do what they are actually supposed to do with that money: Grow. And now, nearly three years on, we’ve helped quite a few startups do that.

Another thing investors on our platform appreciate is the fact that once we notify them of a potential investment, they feel safe with the knowledge that its a deal that has been vetted and stress-tested. Of course, we do encourage them to exercise due diligence, but at the same time, we’ve made things easier for them, too. Thanks to our work, they can commence discussions with founders using a factual document as a basis. It completely takes bias and opinion out of the way, which means the two parties can find common ground much faster.

Who’s the team behind CI?

In terms of employees, it’s quite small. I’ve got two analysts under me. Then we have a network of experts on whom we can lean on to get an opinion, should it be necessary. From a shareholder perspective, we’ve got Jeevan Gnanam, Nathan Sivagananathan and a few individuals who were the brains behind York Street Partners. Apart from them, there are three other minor shareholders who have a stake.

Didn’t CI ever think of running a competition, the way most are inclined to do nowadays?

No, we never did. The thing with competitions is that they end up pitting completely different startups with wildly varying business models against each other. We don’t think that’s right. After all, that’s not how the market works in reality. Another factor driving our decision to not go down the competition route is timing. Any two unique startups will naturally take two different paths when it comes to their ‘Go To Market’ strategy and consequently, their time to market.

What do you look for in a startup?

First off, we try to figure out the link between a problem and the founding team. There are two reasons for this. One is that we want to identify why solving this particular problem is important to the founder. Second, we try to figure out why solving this problem is important from the market’s perspective. That means asking tough questions like ‘how big is the market?’, ‘can it scale?’ and so on..

A lot of people have come to us with ideas, but we’ve had to turn some of them away because we couldn’t see why they wanted to solve it. This link is important because once you start executing, a lot of challenges will come your way, and it is important to have something intrinsic driving you.

Encouragingly, some of the startups we are meeting now have put in a lot of legwork to understand the problem they’re trying to solve in detail. We try to see how hard they’ve worked in trying to gather data, talking to people, etc. Some have spent nearly four to five months just trying to understand the problem without building anything. In the end, they sometimes come back to us and say that the actual problem is completely different from what they had in mind. That kind of understanding is very important, because then they can start making informed decisions about the future direction of their startup.

How does CI make money?

Our revenue streams organised along three verticals: Pre-Raise, Raise, and Post-Raise.

During the Pre-Raise stage, we charge a small nominal fee from the startups to take them through the process of ‘Being Investor Ready’. Initially, we did this part for free, but decided to charge a fee because we wanted to get the startup committed to going through the entire process, and also because we’ve had instances in the past where founders would just drop out. There was no cost to them at the time, but there was to us. Our teams had also invested a lot of time and effort, which went to waste. But, like I said, this is a very minor revenue stream for CI.

Our main source of revenue comes through the Raise itself, via the fee we charge when funds are raised. Right now, it’s set at 4.5% of the amount raised. The system is structured so that we only make money when the company is successful. This way, everyone’s interests are aligned, and it is upto us at CI to make sure the company coming through is worthy of receiving investment.

During the Post-Raise stage, we can provide services to support the entrepreneur to achieve his/her KPIs, manage operations, etc. In return, we take a 2% equity stake in the company.

How can someone come on board as an Investor?

It’s an open platform and anyone can sign up to be an investor. But, as a company and a facilitator of funding, we try to go beyond that by trying to match the right investors to the right startups. A strategic investor can bring a lot of value to a startup over and above that brought by a regular investor.

Would you consider funding to be a challenge for startups in Sri Lanka?

First of all, fundraising is a challenge no matter where you are from. And since the number of startups has exponentially grown, the challenge to raise funds has only increased. In Sri Lanka however, there is money in the ecosystem and the well hasn’t dried up yet, so to speak.

At CI, we tend to focus on founders who have traction and we have a slight preference for those based outside Colombo. The reason to focus on those outside Colombo is that we see a lot of entrepreneurs who have some really good ideas but lack the connections required to raise funds. We can add very little value to founders who already have access to investors. As I’ve travelled around the country, I’ve come across a lot of amazing companies doing outstanding work in terms of building new products, and these guys are based in far-off places like Jaffna and Matara. Some of them even have traction and revenue, but they would never have the chance to receive funding, simply because they don’t have the right connections. For founders from such backgrounds, CI can be of immense help. That said, we don’t believe that anyone can own the investor network and we don’t claim to do so.

What are your views on the local startup ecosystem at large?

Thanks to various startup and entrepreneurship programs, the interest to launch a startup is definitely on the rise. And because of that, the supply of startups in the ecosystem has grown, including in cities outside Colombo. But today’s founders seem to be making the same rookie mistakes founders made 6,7, or 8 years ago.

From the investment perspective, we are seeing a trend where there are so-called ‘Tier 2’ investors coming forward. Typically, they tend to be corporate C-suite executives, in contrast to ‘Tier 1’ investors, who tend to be high net worth individuals.

On the ideas side of things, people – especially those who are away from Colombo – are now trying to solve more complex and unique problems. We met a fantastic company in Batticaloa whose product is a robot that collects plastic from the ocean. This is a broader indication of a slight yet refreshing shift. That said, it’s a slow transition. Most folks are still trying to chase after problems that have long since been solved, unwittingly building ‘me-too’ products in the process.

In terms of entrepreneurship itself, what most local startup founders find challenging, in our opinion, is the ability to execute. Once you receive funding from an investor, what matters is that you use those funds to do what is best for the startup, and in that process, if you burn through the funds, don’t lose your hair over it. The angel/investor would have already become comfortable with losing the money, but as long as you’ve tried to move in the direction of what you promised to do when you went looking for funding, you should emerge better off with your reputation intact. And that, perhaps, is the most valuable currency there is.