In the midst of the shifting global payments landscape, Sri Lanka finds itself in a unique situation. With a small population of nearly 22 million, a mobile penetration rate well above 100%, 21 million debit cards and nearly 1.6 million credit cards in circulation, Sri Lanka appears to be in prime position to go cashless. Yet, cash still remains very much in favour. Can a new wave of mobile payments operators and platforms tilt the scales in favour of a cashless society?

Dialog, The Forerunner

As far as Sri Lanka’s mobile money space is concerned, it is fair to consider Dialog Axiata the pioneer. The telco first launched a service known as EzPay in 2007, which failed to takeoff since it required users to have an account with any one of 3 pre-specified financial institutions. The next iteration, eZ Cash was built keeping earlier failures in mind, and witnessed far better adoption after it was launched in June 2012.

Dialog then went on to launch Genie, a mobile payment aggregator of sorts, which the telco is now actively promoting. To Dialog’s credit, the app has been certified to be PCI-DSS compliant, which is a security standard mandated by Visa and Mastercard.

Enter FriMi

Next up is FriMi, which is a ‘digital bank’ powered by Nations Trust Bank. The app is rich in features, ranging from the opening of accounts to transferring of money. As is evident by the vast number of merchants being roped into the network, FriMi appears to be focused on aggressively building its merchant network in order to increase user stickiness, among other things.

The key difference between Genie and FriMi is that FriMi is connected to a bank account under your name, which is held at Nations Trust Bank, whilst that is not the case with Genie. In other words, Genie is bank-agnostic from a user’s point of view.

Apart from these two services, other banks, such as Commercial Bank and Sampath Bank, are also trying out newer FinTech services, with similar or different value propositions. But for now, it looks like Genie and FriMi are leading the way.

So, how are people choosing to utilise mobile payments?

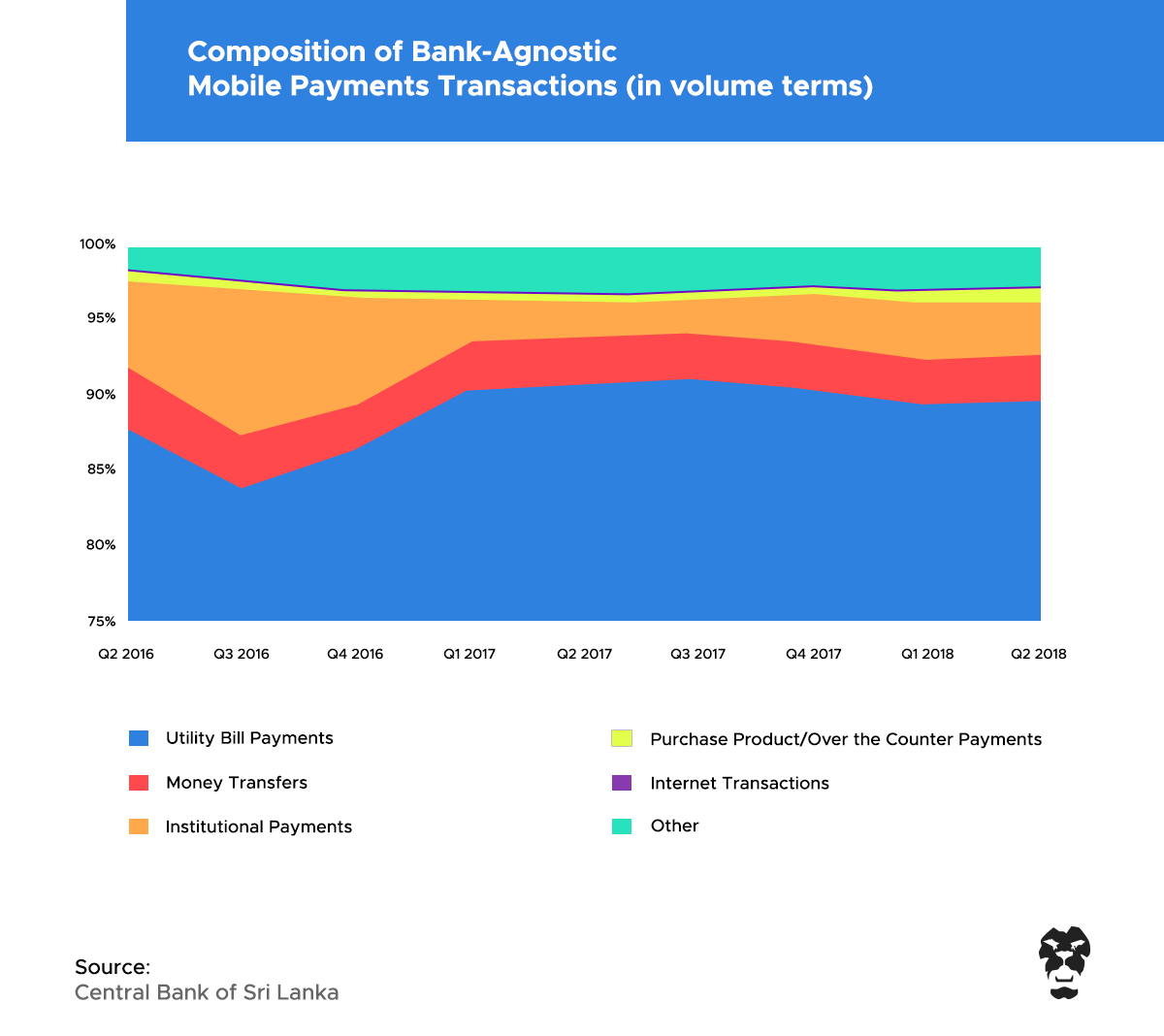

The Central Bank, which publishes data related to the country’s payments infrastructure, separates mobile payment transactions into two categories: Those with a customer’s bank account linked to it, and those without. We’ve termed them bank-dependent and bank agnostic respectively. Going by the data, it looks like bank-agnostic payment platforms are being used mostly to make utility bill payments. However, over the last three quarters, there is a small but noticeable increase in bank-agnostic platforms also being used for over-the-counter payments, such as purchasing groceries at your local supermarket.

Source: Central Bank of Sri Lanka

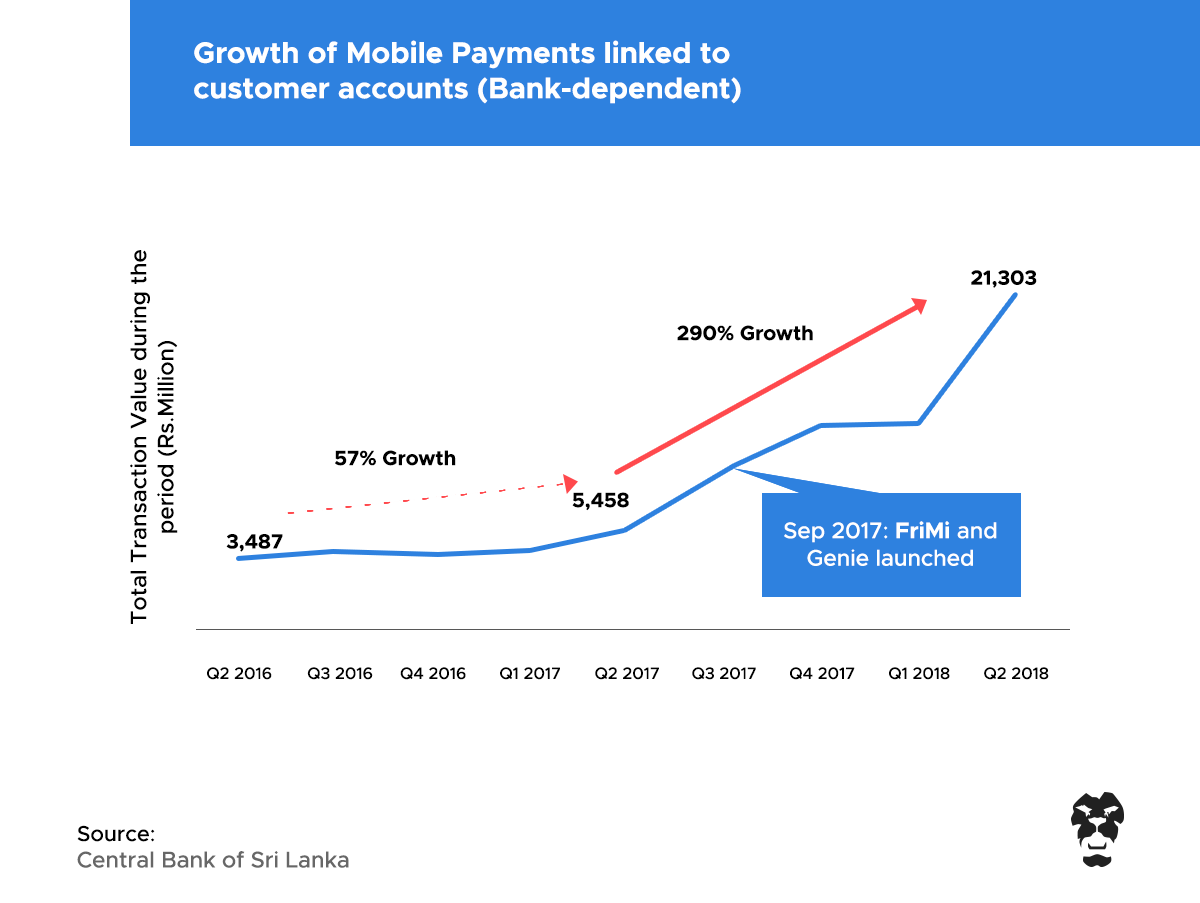

Things get even more interesting when you look at bank-dependent payment platforms, where we discovered that there’s been a clear explosion in usage. As shown in the above infographic, there was a 57% growth in total transaction value between the second quarter of 2016 and the second quarter of 2017. From then onwards though, growth has simply been astonishing. As per the latest available data, the total transaction value of bank-dependent mobile payments for the third quarter of 2018 was just over Rs. 21 billion. However, it is possible that transactions conducted via online banking apps installed on smartphones are also lumped in by the Central Bank. If that is the case, it is still encouraging to see how fast Sri Lankans are adopting such apps.

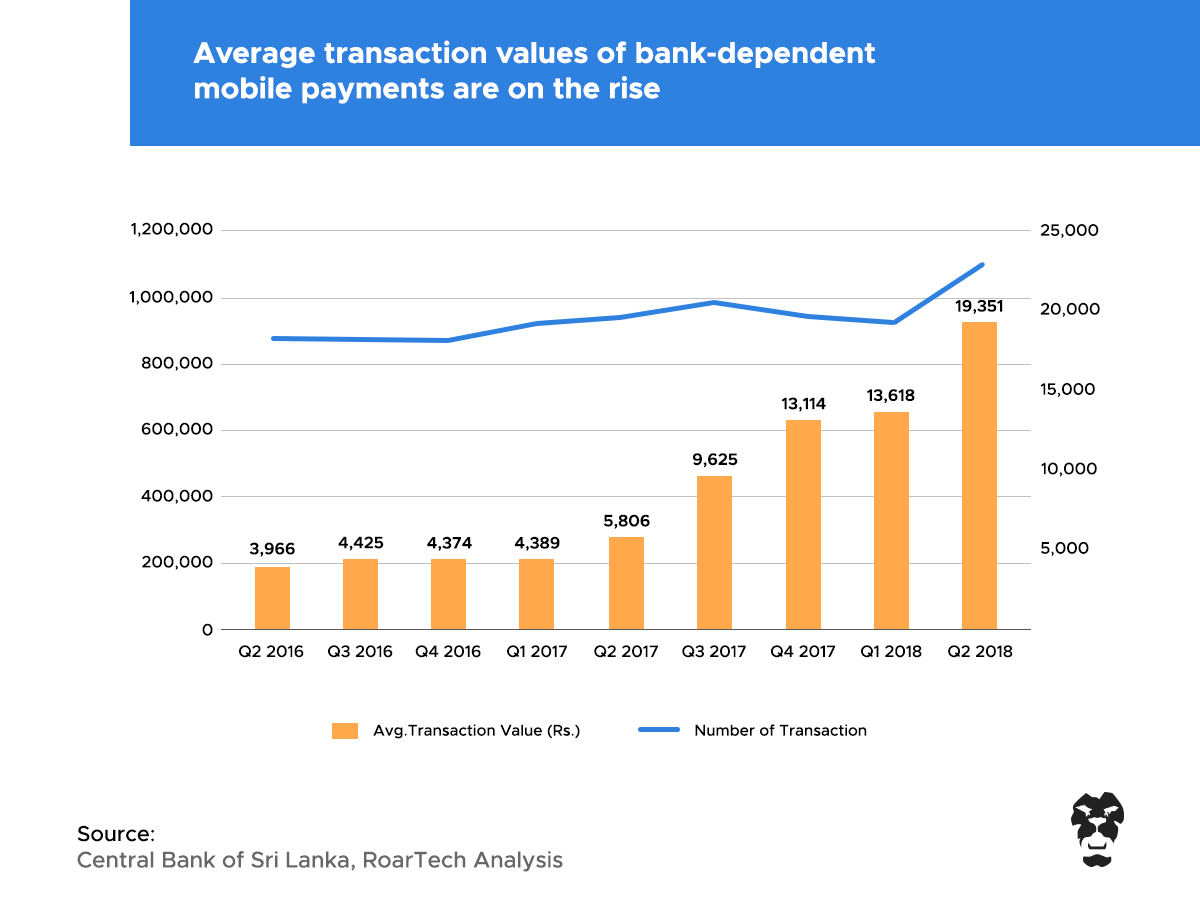

What we also realised after crunching the numbers is that along with a higher frequency of usage, average transaction values have also been increasing. As of the second quarter of 2018, the average value of a transaction conducted via a bank-dependent mobile payment method stood at almost Rs. 20,000, a tremendous improvement from what it was just 12 months earlier (Rs. 5,806). What that means is that not only are people using these platforms more, they are also conducting larger transactions over them. In essence, consumers are becoming more and more comfortable with bidding the physical bank branch goodbye.

Given that a whole new generation of smartphone savvy Sri Lankans are quickly becoming comfortable with mobile payments, you may wonder “what more can be done?”

To answer that question, let’s turn to ‘M-Pesa’, from the African continent, and ‘Paytm’, which operates in India.

M-Pesa and the African mobile payments boom

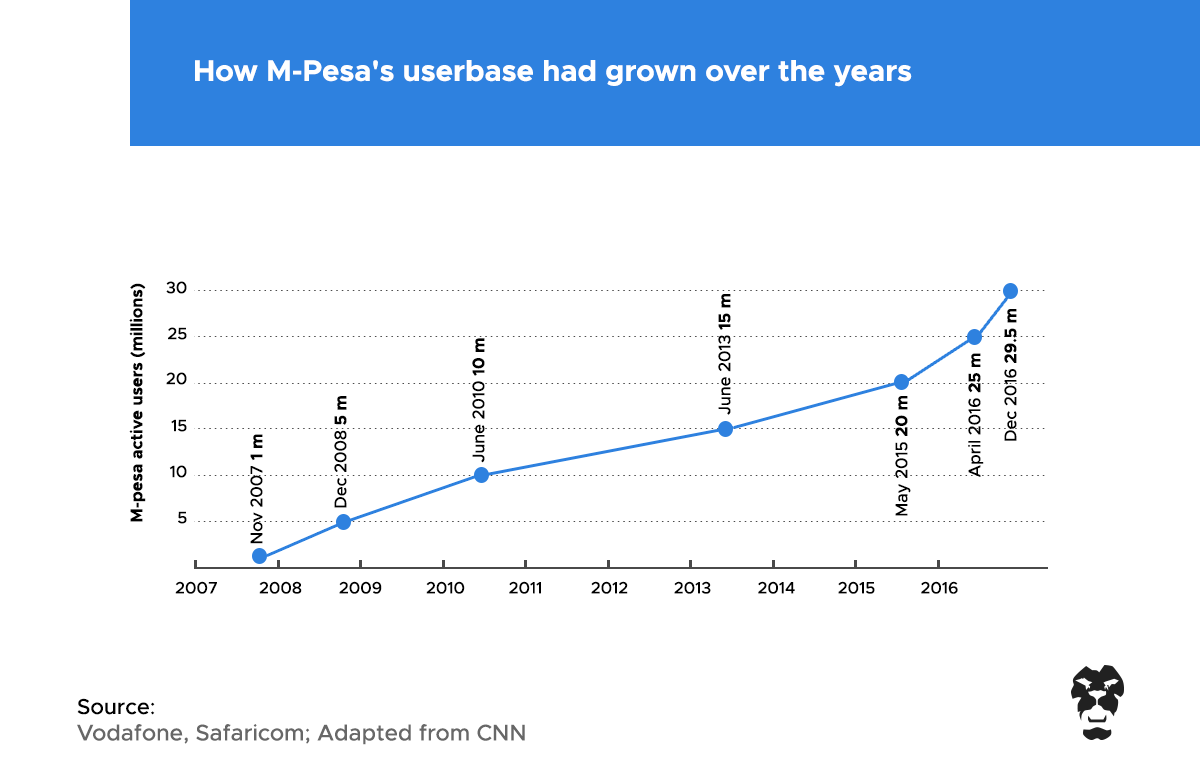

The most widely known case study for mobile payments is M-Pesa, a mobile money service introduced by Safaricom and Vodafone in Kenya. What began as a way of sending small payments between Kenyans has today evolved into a much larger multinational network which enables users to do everything from receiving international money transfers to paying school fees. M-Pesa has become part and parcel of life in Kenya, and shareholders of Safaricom are happy too. In FY2018, M-Pesa revenue accruing to Safaricom almost amounted to USD 621,000. This success has led M-Pesa to become the de facto benchmark for mobile money services in other frontier and emerging markets, such as Sri Lanka, India, Bangladesh, etc.

The Silverback Gorilla Of Mobile Payments In India: Paytm

Paytm was started by Vijay Shekhar Sharma in 2010. Initially, it was a relatively simple service that allowed people to top up their phones and purchase credit for their Direct-to-Home satellite TV systems. However, the company has come a long way since then. Today, Paytm has morphed into a fully fledged eWallet and payments bank which allows users to pay bills, transfer money, buy insurance, and even invest in gold (in a fashion very much similar to how mutual funds work).

In fact, Paytm has evolved and become so successful that it attracted investments from Jack Ma’s Ant Financial, and Warren Buffett’s (arguably the world’s most famous and richest investor) Berkshire Hathaway.

Indian mobile payments services such as Paytm are now at a point where they’ve begun acting as ‘all-in-one’ destinations for low-value transactions and even banking services. These platforms are now providing their users with the ability to top-up phones, book hotels and airline tickets, pay traffic fines, pay highway tolls, recharge train season tickets, and a host of other services. Essentially, they’re building a complete ecosystem of services around their respective mobile payments platforms, which will obviously make life easier for the user. And that is where we think Sri Lanka may also be headed.

Once our own homegrown mobile payment services start gaining a significant amount of traction, it is only natural for them to start thinking about offering other services, perhaps along the lines of their Indian and Kenyan counterparts. That is because as they grow, they will eventually start to jostle for market leadership. And in order to gain market leadership, you ought to differentiate your product offerings from your competitors’; and the way to do that is through innovation. In other words, by offering newer, better, and different types of services and capabilities. A good example would be Pickme, which first launched as a service to hail tuk-tuks, but now offers everything from lorries to tour packages and food.

Prof. Rohan Samarajiva, current Chairman of the ICTA, is optimistic about the growth prospects for the sector. When asked about for his views, Prof. Samarajiva said that “Sri Lankan mobile financial services, including but not limited to m-payments, have not reached their full potential yet”, and that “as greater opportunities for online payments emerge because of the proliferation of e-government services and e-commerce, and the current artificially low daily thresholds are raised by the regulator, it is likely that m-financial services will take off”.

We also asked Prof. Samarajiva about what a mature ecosystem would look like and whether he sees local services mirroring their foreign peers, to which Prof. Samarajiva responded: “We in government are not best positioned to speculate on what a mature ecosystem will look like. Indeed, even researchers and entrepreneurs are on weak ground when imagining what an ‘end-state’ ecosystem will look like. That is because what emerges in the end is a result of the interaction of the basic causal mechanisms which are common across countries and country-specific conditions. Lots of effort has been expended on replicating M-Pesa, but with little success.

Basically, M-Pesa was such a success because the alternatives modes were so awful. It is unlikely that any country could replicate that in the same form. China has made m-payments commonplace in a completely different way.

The Payments Bulletin issued by the Central Bank provides data on ‘regular banking’. In 2017, there were 19.7 million debit cards in use, which suggests that bank-centric payments may have a major role in Sri Lanka – especially if the number of POS terminals increases further from 48,828 in 2017, and POS transaction volumes also increase. Volumes more than doubled over five years to LKR 83.9 million in 2017. That is why I anchored the case for m-payments on online transactions. But even here, it will all depend on the relative convenience and cost of the different modes of payment.”

Prof. Samarajiva also shared with us an interesting report on the subject, which you can find here.

As this natural cycle of evolution takes place, the average Sri Lankan will eventually find themselves blessed with an array of services which will save them a lot of time and money. And honestly, it’s hard to complain about that.

How do you think the Sri Lankan mobile payments landscape will evolve? Let us know in the comments!