After weeks of speculation and trepidation, Finance Minister Ravi Karunanayake yesterday finally unveiled the Yahapalana Government’s Budget for the year 2017. Likening the budget document to a decisive final battle in a long-drawn war, an uncharacteristically emotional Karunanayake harkened back to a statement by former Army Commander Field Marshall Sarath Fonseka and vowed not to leave the “economic war” to the future generations of this country.

“The need of the hour is an economic, social and environmental transformation ensuring a better tomorrow for all Sri Lankans. A national development strategy to build a green and innovation-based economy through progressive reforms will ensure a better future for the children of the country, and particularly for the educated younger generation,” Karunanayake told Parliament.

Budget 2017 has been lauded as being progressive and effective by some, while others have called it worthless and full of austerity measures that will add to the burdens of an already beleaguered people, calling into question the many reductions in expenditure. The truth, as is often the case, probably lies somewhere in the middle, and while it’s still early days and any useful analysis will take some time and further scrutiny, it’s worth examining some of the more far-reaching implications of the pronouncements made in the House yesterday.

Cuts In Crucial Sectors?

Finance Minister Ravi Karunanayake preparing for his highly anticipated budget presentation. Image courtesy Daily News

In the week leading up to the Budget reading, reports began to emerge that government expenditure on education for 2017 was to be slashed by an alarming amount. There will be a 40% cut in education spending, claimed some headlines. The Appropriation Bill for 2017 seemed to confirm these fears, with just Rs. 76.94 billion allocated to the Ministry of Education and Rs. 163 billion for Higher Education and Highways. A significant drop compared to last year’s Rs. 185.97 billion and Rs. 171 billion. At least on the surface.

It was the same with the health sector ‒ from Rs. 174.08 billion in 2016 to Rs. 160.97 billion in 2017. Activists were starting to cry foul. This Government is spending less and less on crucial sectors, they protested.

It turns out, however, that it’s a bit more complicated than that. It’s less to do with indiscriminate cuts and more about capital expenditure vs. recurrent expenditure.

According to Chief Economist at the Ceylon Chamber of Commerce Anushka Wijesinha, it all depends on where the money goes.

“The Education Ministry has got a smaller share of the overall budget than last year, but the capital expenditure budget has increased by 122%, while the recurrent expenditure budget has contracted by 78%,” he told Roar.

Minister Karunanayake in his speech said that education spending, though slashed significantly, is still 70% higher than 2014. Which is not untrue.

“By monetary value, the Education Ministry shows the largest increase in the capital Budget and the top loser on the recurrent Budget,” said Wijesinha.

FUTA and other advocacy organisations have long been demanding 6% of GDP for education in Sri Lanka. Image courtesy D.B.S. Jeyaraj

On health, 2017 sees a slightly smaller share of the total Budget than last year, but a 12% rise in the capital budget and a 13% cut in the recurrent budget compared to last year, Wijesinha said, adding that the Ministry of Health is the fourth highest gainer on the capital budget, and fourth biggest loser on the recurrent budget.

“It would be interesting to see where and how the Government plans on making these cuts to recurrent spending. It might be in streamlining activities, but it’s hard to tell without seeing the specific measures. Recurrent refers mainly to salaries and other emoluments. I guess we can never be satisfied with how much is allocated for social sectors like health and education ‒ especially as these needs are always evolving and can always do with more spending. These investments help to drive growth in the long-run,” said Wijesinha.

Unsurprisingly, allocations cited for different ministries don’t always tell the whole story. As Wijesinha points out, in education, for example, there is spending from other ministries and line items to consider, too, such as Provincial Council allocations.

Economist Ahilan Kadirgamar, speaking to Roar from New Delhi, said education expenditure needs to be disaggregated and broken down by looking at budget estimates in order to come to an informed conclusion on whether or not there has indeed been a significant reduction. The bulk of education spending happens through the provincial councils, he said.

“Add it all up and we’ll know how much of a decline it is compared to last year,” he said.

According to Wijesinha, “Ultimately what matters is not so much the movements from one year to the next ‒ there can be many reasons for that ‒ but what is more useful is to look at their allocations as a share of the total Budget outlay, and also if there is more capital expenditure planned.”

Defence expenditure too will see a drop in 2017 ‒ from Rs. 306 billion last year to Rs. 284 billion. Kadirgamar, though largely critical of the budget overall, sees this as a salient step towards progress.

“My position is that any time there’s a defence cut, it’s a positive thing,” he said, pointing out that it’s been seven years since the end of the war.

Budget 2017 had a special focus on ongoing digitisation efforts by the Government as well as infrastructure development in telecommunication.

“Telecoms and Digital Infrastructure is a key new area that needs more investment. And the capital budget of this Ministry has risen by 653%, from Rs. 308 million last year to Rs. 2.3 billion this year,” Wijesinha told Roar.

“There have also been increases in the allocations for upcountry infrastructure and housing, which is important, given that even today, as poverty rates in the estate sector are higher than in rural and urban, there are a lot of unmet infrastructure and social sector needs there,” he added.

Money spent on science and technology, however, could’ve seen a bigger rise, he said.

“I would have liked to see a much higher allocation for the Ministry of Science, Technology and Research ‒ that’s a key area we keep consistently underinvesting in. The Budget has only marginally risen there.”

President And Prime Minister

The offices of both the President and the Prime Minister have witnessed significant increases in budgetary allocations. Image courtesy nation.lk

Increased budgetary allocations for the offices of the President and Prime Minister have raised some eyebrows this year. A whopping Rs. 6.4 billion in 2017 from the Rs. 2.39 billion last year for the President, and Rs. 1.2 billion for the Prime Minister from a measly Rs. 486.1 million in 2016. However, it is worth noting that this is still peanuts compared to the colossal amounts of money allocated to the former President and his family members a few years ago.

“They controlled something like 60% of the budget,” Kadirgamar pointed out.

Without looking at the budget estimates, however, it’s very hard to say what this government is trying to do with this increase, he said, alluding to capital carrying costs and other “accounting gimmicks” employed by the Government.

Although, looking at the bigger picture, it’s not that significant an increase, he conceded.

Wijesinha is largely unconcerned.

“First we have to note that their size in the overall Budget is very small ‒ the President’s office accounts for 0.35% of the total allocation and the Prime Minister’s is 0.07%,” he told Roar.

“But of course, as taxpayers, we should feel that the increases aren’t ideal at all. There is a 145% increase in the recurrent Budget for the Prime Minister’s Office, and a 12% increase in the same for the President’s office. There is an 183% increase in the capital budget for the Prime Minister’s Office and a 600% increase for the President’s office. We don’t know the specific items that are driving these changes. Of course, last year there was a sharp and noticeable cut in these Budgets, as it was a campaign promise to cut down on expenses of politicians,” he said.

The high percentage increases, therefore, are driven by this base effect, said Wijesinha, adding that no one can simply say the increases are wasteful. Some of the reconciliation work (the Secretariat for Coordinating Reconciliation Mechanisms and the Office for National Unity and Reconciliation, for example), as well as bribery and corruption investigations, might be coming under their offices as projects or initiatives, he noted.

“Often, a lot of key activities occur under these offices, and so without knowing more we shouldn’t jump to any conclusions. But as taxpayers, it’s justified for us to ask what the increases are going towards. Transparency is important. Let’s put it into perspective. The capital Budget of the President’s office (roughly Rs 4.5 billion) is now a little less than double that of the Ministry of Digital Infrastructure and that of the Ministry of Science, Technology and Research,” he said.

Revenue

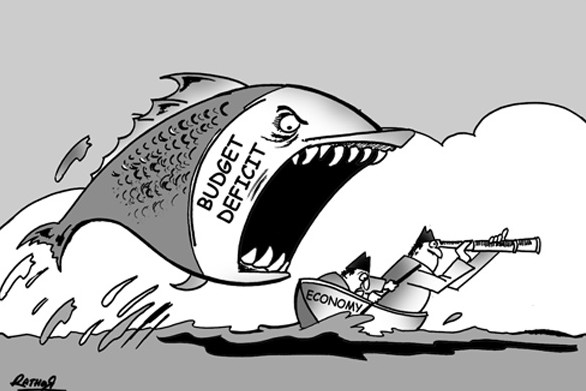

Sri Lanka is facing a crippling debt trap or balance of payment crisis. The Government has been forced to take drastic measures to increase state revenue to overcome this and also to bring down the budget deficit to 4.7% ‒ equal parts in desperation and to meet a condition imposed by the International Monetary Fund (IMF) when it offered Sri Lanka a USD 1.5 billion extended fund facility in July this year.

Budget 2017 is reflective of these measures to get out of the debt trap. The Government hopes to raise a total of Rs. 140 billion in revenue next year, through, among other things, corporate taxes, personal income taxes, and a capital gains tax to be introduced by April.

Sri Lanka’s debt at a glance. Data courtesy Ministry of Finance.

Among revisions to corporate and withholding taxes in 2017 will be three slabs of 14%, 28% and 40% corporate income tax instead of the current single rate of 28%, which is expected to bring Rs. 32 billion out of the total Rs. 140 billion. Withholding tax increase from 2.5% to 5% is expected to raise an additional Rs. 26 billion, and a 10% capital gain tax is expected to add Rs. 5 billion to the Treasury.

Despite these increases in direct taxes, however, according to left-leaning economists like Ahilan Kadirgamar, this year’s budget is of an austere nature in that the Government has put the bulk of the burden on the hapless citizenry by decreasing government expenditure.

“Total capital expenditure in this budget is lower than 2015, almost to the level of 2014,” Kadirgamar, a staunch advocate of direct taxes over indirect taxes, told Roar.

“The government is cutting any kind of new investment in society. That much is clear. It is austerity in that sense,” he added.

Though there is talk of dramatically increasing revenue in the budget, he told Roar, a lot of that revenue will be collected via taxation of goods and services. In spite of the increase in direct taxes, there has been a year-on-year increase in indirect taxes over the past few years.

“Based on what I’ve seen so far, I consider this a very worrying budget,” said Kadirgamar, attributing his concerns to decreases in expenditure and the “continued increase in VAT.”

Wijesinha, however, is hesitant to call this an austerity budget.

“This is hardly the case. Look at the spending proposals announced in the Budget today – Annexe IV. Rs 200 billion more in public investment (with Rs 141 of that coming from health and education and Rs 567 from infrastructure). New expenditure proposals contained in the Budget today (Annexure II) come up to about Rs 140 billion,” he said.

Kadirgamar was also critical of what he called the Government’s persistent efforts at privatisation.

“Overall, the entire policy trajectory, from the PM’s policy statement onward, has been indicative of this. There are three pillars in how they’re trying to take the economy forward: Trade liberalisation, increased financialisation, and privatisation in different forms (PPPs, etc.). All three are worrying – particularly so in the case of trade liberalisation. What we’re seeing globally, what with the emergence of Trump, for example, is a protectionist trend. There are global trends towards protectionism,” he said.

Citing World Trade Organisation (WTO) statistics, Kadirgamar said that in the 1990s, global trade was twice the rate of global economic growth ‒ a trend that appears to have flipped over the years.

“For example, this year they’re projecting a 2.3% global economic growth. In the 1990s, global trade would’ve been increasing at double that rate, close to 5%. This year, the opposite is true. Global trade is less than global economic growth. This year it’s about 80% of economic growth. In other words, demand for exports is very low at this point. Every country is also trying hard to export. In that context, to liberalise trade will be quite disastrous,” he said.

Whether or not Budget 2017 is a good budget depends on whose perspective you look at it from. According to Kadirgamar, creating an environment conducive to furthering corporate interests through government policy does not necessarily translate to an increase in production and exports.

“Who’s going to bear the brunt of this? From the ordinary person’s perspective (the worker, farmer, fisherman, et al) it’s a very worrying budget. The overall thrust is that they’re trying to they’re catering to business confidence of the corporate interests. The corporations would gain in the process. But just because corporations gain, it doesn’t mean there’ll be a production increase or export increase,” he said.

“Corporate profits will increase for sure, but whether that will lead to greater production and export from a national economic perspective is questionable,” he added.

More Than Meets The Eye

Large allocations aside, spending must be well-planned. Image courtesy nation.lk

The media, as well as the public, often tend to get caught up in budgetary allocations, sometimes forgetting to consider the bigger picture.

Economist Anushka Wijesinha told Roar that many are concerned with the budgetary allocations each year, but not enough on the spending efficacy and value for money.

“These measures don’t yet exist for Sri Lanka. We have to start pushing more on this. We can have big increases in health and education budgets, but if the spending is poorly planned, if resources are misallocated, initiatives are duplicated, monitoring and evaluation is not done, and development results are not achieved, then it’s of little use simply increasing the money spent. Expenditure increases should necessarily come alongside value for money and efficacy considerations,” he said.

People shouldn’t also be quick to dismiss private participation in state enterprises, Wijesinha said.

“We must also be more open to private sector participation in achieving social outcomes. Even highly statist countries like China have begun partnering with the private sector and NGOs to deliver health, education, and social welfare. There’s plenty of examples around the world. The state can’t do everything. It can cleverly partner with the private sector to get some of this done, in a way that achieves the development outcomes, while reducing the burden on the Budget. You can structure PPP (private public partnership) contracts not just for roads and ports, but also for schools, universities, hospitals, and public housing. It can be done in a way that doesn’t risk the poor getting hurt by pure profit motives, but still delivers the services that the Government wants to see delivered,” he said.

Conclusion

Budget 2017 is likely to be passed in Parliament without much amendment. Some provisions in last year’s budget were not implemented due to various reasons, but overall, the Government seems to have hit the right notes this time around – the significant reductions in expenditure notwithstanding. Will the Unity Government succeed in meeting its targeted revenues over the next fiscal year? Only time will tell.