Man is a funny animal. He has a tendency to be swept up by half-baked ideas, following which he kicks his common sense to the curb. He then proceeds to pursue these ideas with vigour for a considerable amount of time. After such time however, the shaky foundations upon which these ideas were constructed come crumbling down, and he finally realises his folly. However, he soon forgets, and the cycle repeats itself again, albeit after a period of relative calm.

This tendency to take leave of one’s common sense is perhaps man’s greatest weakness.

History is littered with examples of how this one flaw can be very dangerous. Just look at the earliest recorded financial bubble ‒ the Tulip mania of the 1630s ‒ a period during which people went mad for tulips, of all things. It’s not only ordinary men who usually fall prey to such delusions. Sir Isaac Newton, one of the smartest people in human history, lost £20,000 (about £3 million in today’s terms) during the South Sea Bubble. Subsequently, he is said to have quipped “I can calculate the motions of heavenly bodies, but not the madness of people.”

Seriously, who goes mad over tulips? Image credit: Nexter.org

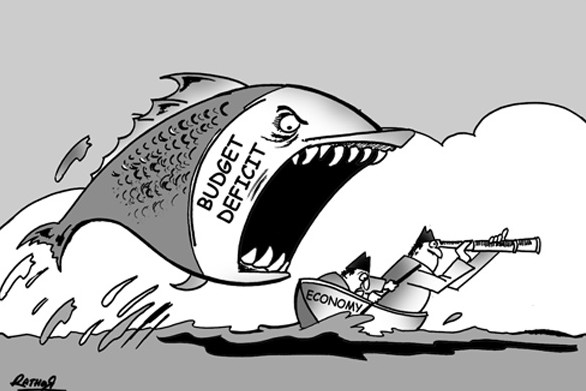

Sometimes, though, this flaw rears its head in the arena of economic policymaking. This is very much evident Sri Lanka, a country where local policymakers, politicians, and certain groups of businessmen swear by a flawed economic doctrine from the 16th century known as ‘mercantilism.’ Or as most Sri Lankans know it, “We must restrict imports, and increase exports.”

What Is Mercantilism?

Simply put, mercantilism is the name given to an economic doctrine which dominated Western economic thought between the 16th and 18th centuries. People of that era believed that if a country was to enrich itself, it should restrict imports and encourage exports. They believed that following such a policy will help a country achieve a favourable balance of trade. In other words, they believed that a country should strive to produce whatever it wants within its geographical boundaries (how else do you restrict imports?), and that the excess should be exported, if possible.

How Did This Idea Develop?

In the 16th century, large, competitive nation states were consumed by a need to expand their territory. In order to pursue such a goal, it became necessary to maintain large, professional armies. And since war doesn’t come cheap, governments needed a lot of cash.

During those times, society was divided into three broad classes. There was a ruling class, a mercantile class (those who were in business), and the ordinary citizenry, who made up the working class.

Here’s where things get interesting. The mercantile class realised that fat profits were to be had by keeping competitors at bay. As basic economic theory dictates, when one player enjoys supernormal profits over the short run, the industry will attract new entrants, all else remaining equal. Over the long run, all firms in the industry will earn normal profits, thanks to the increased competition, which is what should happen (ideally). This sort of behaviour by individuals is just basic human nature.

But what if one could eliminate competition for good? This would surely benefit the mercantilists.

The London offices of the British East India Company. Image credit: Wikipedia

The business classes realised that the government desperately needed money, for which taxes would have to be levied on the common man. In this, our crafty mercantilists saw a way out. They struck an implicit deal with the ruling class.

In exchange for paying taxes, mercantilists convinced the government to protect their business interests against competition (back then, competition was mainly foreign). Why? Because barring other people from entering your industry will allow you to become the industry. And that means gaining the ability to set prices as you wish.

So the government went about setting up barriers to free trade, not by building walls, but by enacting policies which favoured mercantilists. These barriers took on many forms, ranging from tax exemptions, outright grant of monopolies, tariffs, and quotas. Thanks to these policies, mercantilists were able to fatten their wallets, at the expense of the working class and the downtrodden. The most famous mercantilist firm of them all? The British East India Company.

Sri Lanka’s Mercantilist History

Sri Lanka wouldn’t have a successful apparel industry if not for the open economy. Image credit: Bloomberg-Getty

The history of the little island in the Indian Ocean is dotted with instances of how mercantilist firms stifled the liberties of the common man. From the telecom monopoly which lasted until 1997, to the power generation and transmission monopoly which exists to this day, the examples are many.

Why Is It Bad?

So why is mercantilism bad, you ask. In order to paint a clearer picture, let’s first have a look at the number one reason cited by local lobbyists whenever they cry out against free trade.

“If free trade privileges are granted, giant multinationals will dump their products, kill local producers, and then raise prices.”

Let’s assume for a moment that a foreign firm behaves exactly in this way. The common man is going to suffer, right? Wrong. Remember, when free trade exists, any producer is able to enter and exit the market at will. If one firm raises their prices to an abnormally high level, free trade will only encourage another firm to enter the market, and supply goods at lower prices, thereby stealing market share from the first entrant. And who’s going to benefit from this?

The common man, of course. Because of increased competition in the market, he will end up paying a lower price. And since lower prices automatically translate into more cash in one’s pocket…

A group protesting against the recently signed Trans-Pacific Partnership (TPP). Image credit: CT Post

Having dealt with that part of the equation, let’s examine why mercantilist policies are harmful to an economy:

1. It breeds inefficiency, thereby costing people more money

No country in this world has everything it needs. Therefore, in order to do well, each country must use its own resources as effectively as possible. It should produce high-value products, which will, in turn, fetch a higher price in the marketplace. In short, a country should aim to embrace the benefits of specialisation.

Here’s an example. Imagine a small village where people grow their own food, sew their own clothes, build their own houses, and paint their own fences. And since they only have 24 hours in a day, they can’t devote much time to master any of these activities. No matter how hard they try, they will always end up with unremarkable clothes, shoddily-built houses, and poorly painted fences.

This village would’ve probably looked like a primitive version of the Flintstones. Image credit: The Everett Collection

One day, a guy with a PhD in Industrial Design finds his way to the village. He builds the villagers a sewing machine, which helps them sew their clothes in double quick time. The villagers use the time they saved to sew a few more clothes, which they then exchange with the designer, as payment for his invention.

As time passes, the villagers become good at sewing clothes and end up having more clothes than they can ever wear. Word about the little apparel producing village spreads far and wide, and soon, a teacher arrives in the village. She offers to tutor the kids, and accepts payment in clothes. This frees up some more time for the adults of the village, which they now spend producing even more clothes. The pattern repeats itself, and very soon, the village is transformed into a bustling hub of commerce.

Whatever progress the villagers made, came because they ended up specialising in something.That’s what specialisation does. It makes us productive, and thereby, richer and far better off than we would’ve ever been.

Now, back to what we were talking about.

By closing the door to free trade, and insisting on producing almost every little thing within the country itself, Sri Lanka will only end up with an inefficient economy. An inefficient economy will not harm the rich, but the poor, since it will drive costs up and quality down.

2. It limits freedom of choice

Every citizen is entitled to the right to spend his money on whatever he wants. If he wants to buy a car with a Hot Pink paint job, then he should be able to do so, provided he has the money to pay for it. However, when mercantilist firms control the market, they will always limit the choices available to the end consumer. The logic behind this is very simple. Fewer product lines equal lower overheads, which can be spread out over a higher volume of output. This will result in a lower per-unit cost a.k.a. Economies of Scale.

Take for instance the British East India Company, a somewhat extreme example, which benefitted a lot from its size, power and reach. Since the company controlled the spice trade, one could only buy what the company held in its inventory. If you wanted, say, coarsely-ground pepper and the company didn’t have it in stock, you were out of luck. You had no choice but to buy dried pepper pods instead.

What Is The Antidote To Mercantilism?

Easy one, this is. The antidote for mercantilism is, and always has been, free trade. Much like how Niki Lauda and James Hunt inspired each other to become the best F1 drivers of their era, competition between firms will only result in better, and cheaper products.

The rivalry between these two is the stuff stories (and movies *wink wink*) are made of. Image credit: Digital Spy

At this point in time, it is very important for the general public to encourage initiatives which will help Sri Lanka carve out a place for itself in the global economy. Free trade agreements and the abolition of high import tariffs will benefit the poor, and not the rich, as is usually claimed. On the other hand, homegrown Sri Lankan firms need to embrace competition, and not shy away from it. Because at the end of the day, competition is perhaps the most effective driver of productivity, and in the long run, it is productivity that matters the most to an economy.

Featured image courtesy courier.lk