Another month has gone by, which means we’re now almost 60% through 2016. It is no secret that the CSE has been a relatively lacklustre performer this year. Around this time last year, the ASPI was trading at levels between 7,400-7,500 points. Fast forward to the present and it is trading firmly in the 6,500-point territory.

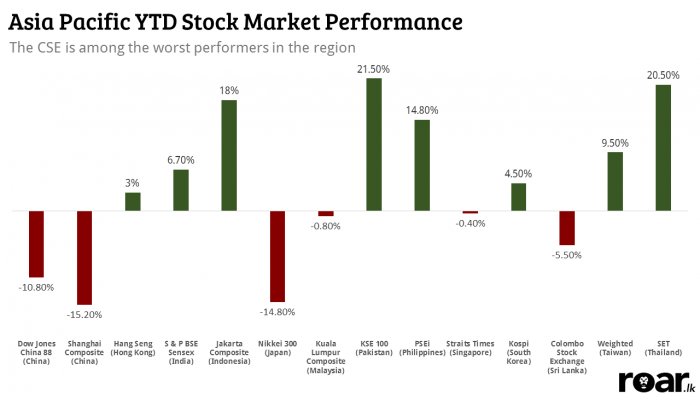

Data courtesy The Wall Street Journal.

As the chart above shows, the CSE is among the worst performers in the region. While a lot of factors have contributed to this, a large part of the blame falls on the spectres of policy uncertainty and macroeconomic weakness.

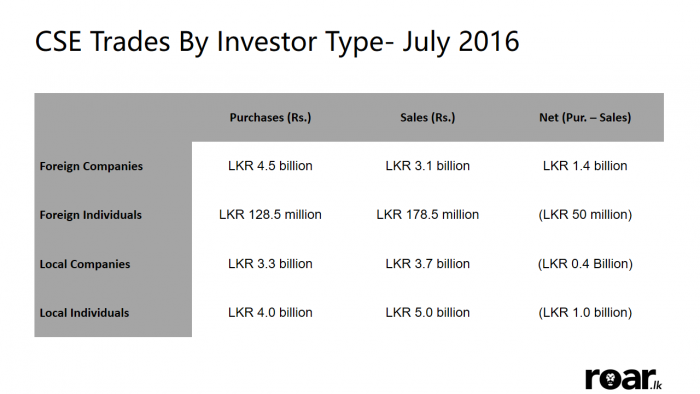

Of course, every dark cloud has a silver lining, and we mentioned last month that the downturn would delight long-term investors, since they’ll be able to load up on valuable blue-chips at very attractive prices. Just as we predicted, Foreign Institutional Investors bought into the market, resulting in a net inflow of LKR 1.4 billion.

Stock Market performances – July 2016

On the flipside, Local Individual Investors became net sellers to the tune of around LKR 1 billion, displaying the short-term thinking, which tends to dominate the domestic individual investor circles.

All in all, the ASPI and the S&P SL20 gained 1.76% and 3.46% respectively, during the month of July. As a result, the market’s PER also increased to 13.1x, up from 12.98x a month earlier.

Do check back next month for some more info!

The comments, opinions, and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Always seek independent advice.

Featured image courtesy dailyceylon.com