Ah… taxes. Nothing has the power to topple governments, and divide political coalitions like a tax. Just ask PM Modi over in New Delhi, who has been struggling to push a Goods and Services Tax through the Rajya Sabha, or former US President George W. Bush, who was known for his infamous tax cuts.

Taxes are the most important source of revenue for most governments. The rationale for levying taxes is simple: tax revenues will allow the government to build roads, maintain parks, and pay people who work for the government.

Some countries understand the importance of adequate tax revenues and have robust tax laws which simplify taxation for both the payee and the payer. Others, like Sri Lanka, don’t, and have complicated taxation systems which in turn hurt revenue generation. We highlighted this very same issue in our editorial for the month of March 2016.

The complexity of the island’s taxation systems is very much evident in the number of different taxes which exist side by side. Of course, not all of these taxes are levied at the same time, and on the same goods. One must also remember that what matters at the end of the day is the tax burden, a.k.a the total amount that is payable in taxes, and not the number of taxes per se.

With the fine print out of the way, here are a few Sri Lankan taxes which you should know about.

1. Income Tax: Personal

Personal Income Tax is a tax which you pay on your income. In Sri Lanka, not everyone is liable to pay Personal Income Tax. You will only qualify to pay this tax once your income (read: income, not just your salary) goes surpasses a certain tax-free threshold.

According to the 2016 budget, Personal Income Tax was to be levied at a single standard rate of 15% (this was later amended to 17.5%). The payment threshold has also been increased to Rs. 2.4 million per annum, that is to say your annual income should exceed Rs. 2.4 million (or 200,000 a month) before you become liable to pay the tax.

Individuals queue up to file their tax returns in India. Image credit: The Hindu

According to the Department of Inland Revenue (IRD), Personal Income tax ought to be paid on a self-assessment basis (basically, you’re supposed to file your tax return), in five installments, every year.

Pay As You Earn (PAYE) taxes are quite different from Personal Income Taxes. PAYE is calculated on Employment Income alone, and is collected by one’s employer on behalf of the government.

2. Income Tax: Corporate

This is the tax which corporates ought to pay on profits generated from their business activities. Other types of income, like Interest Income from Fixed Income Instruments, are normally taxed at source, which means that in the hands of the holder, they are essentially tax-free.

The 2016 Budget proposed a standard rate of 15% to be levied on all sectors, except the following:

- Betting and Gaming

- Liquor

- Tobacco

- Banking and Finance (including insurance, leasing, and related activities)

- Trading activities other than manufacturing or provision of services.

The above were to be taxed at a higher rate of 30%. A later amendment suspended these proposals for a year, resulting in companies having to pay the existing 2015 rate. Needless to say, this did cause quite a bit of confusion.

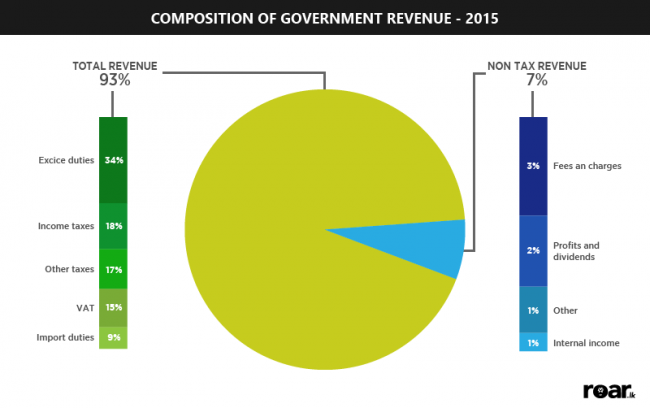

According to the Central Bank’s Annual Report for 2015, Income Taxes contributed a combined 18% of the Government’s total tax revenue that year.

3. Value Added Tax (VAT)

A tax that is having its moment in the spotlight right now, VAT is the most widely known type of indirect tax.

Given all the noise, you probably know that Sri Lanka recently hiked its VAT rate to 15%. The authorities also reduced the tax-free threshold to Rs. 3 million per quarter, or alternatively, Rs. 12 million per annum. How it usually works the world over is that if your ‘taxable turnover’ exceeds the tax-free threshold, then you, as a trader, would become liable to pay VAT. Since VAT is paid by the end consumer, it is your (the trader’s) responsibility to remit the VAT revenue you collect to the IRD.

VAT revenue accounted for 15% of the Government’s total tax revenue in 2015.

4. Nation Building Tax (NBT)

A man makes inquiries at a local tax office in India. Image credit: The New Indian Express

Introduced in 2009, NBT is based on turnover and tends to piggyback on VAT. Here’s an excerpt from an article written by Dharmadasa Ranagalle, the then Deputy Commissioner of the IRD:

“NBT was introduced to Sri Lanka in 2009 under the Nation Building Tax Act No 9 of 2009 as a social contribution towards the welfare of security forces and rebuild communities and infrastructure facilities affected by terrorism. The tax was initially levied on the turnover of importers, manufacturers, and services providers at a rate of 1% with effected (sic) from 1st February 2009. The rate was increased to 3% with effect from 1st May 2009 and up to now 3% of the rate is applied except for the business of manufactures and sale of rice manufactured by locally procured paddy (1.5%). Since the tax was introduced for the specific purpose and the public informed accordingly there was a good response for the payment of taxes.”

The 2016 budget put forward a proposal to increase NBT to 4% from 2%. However, an amendment was later brought forward to scrap the increase.

5. Economic Service Charge (ESC)

ESC is… well… quite different. It was originally introduced in 2006 to broaden the Government’s revenue streams. Here’s what the IRD’s website says about the ESC:

“Economic Service Charge (ESC) has been administered since 1st of April 2006 under the Economic Service Charge (ESC) Act No. 13 of 2006, as amended by Economic Service Charge Amendment Acts No. 15 of 2007, 11 of 2008, 16 of 2009, 11 of 2011, 11 of 2012 and 06 of 2013. Prior to this, it has been administered under Finance Acts 11 of 2004 and 11 of 2005 from 01.04.2004 up to 01.04.2006. ESC operates as an advance payment of income tax in respect of any person whose liability to income tax exceeds the ESC liability and such person bears no burden of the ESC.

A person whose contribution to income tax does not exceed ESC liability, for instance in the case of a loss-making business, ESC has to be paid and no deductions can be effected elsewhere. With effect from 01.04.2012, ESC is payable only by any person or partnership who or which enjoys tax exemption or has taxable losses. ”

With effect from the April 1 this year, the ESC rate was increased to 0.5% from 0.25%.

6. Customs Duty

This is the tariff imposed by the Customs on imports. Customs duties are levied based on a system called the Harmonized System (HS System for short), which is an internationally standardised system used to classify traded goods.

Before the 2016 budget, a 4 band structure was used to determine the exact tax rate of a particular good. Thanks to the last budget, the structure is now a 3 band one (0%, 15%, and 30%)

This revenue stream accounted for around 9% of the Government’s total tax revenue last year.

7. Ports And Airports Development Levy (PAL)

Another quite recent introduction to the local taxation system, PAL is supposed to just what it says: help develop Sri Lanka’s Ports and Airports. PAL is normally levied on imports, and is paid to the Customs.

From the Ports and Airports Development Levy Act, No. 18 of 2011:

“2. Levy on articles imported into Sri Lanka.

Subject to the provisions of section 7, there shall be charged and levied on the cost, insurance and freight value of every article originating from outside Sri Lanka and imported into Sri Lanka, a levy to be called the Ports and Airports Development Levy (hereinafter in this Part referred to as the “Levy”).”

The Act does allow exemptions for raw materials which are imported for processing and export, and also for projects which qualify for tax concessions, according to the BOI.

The last budget had in it a proposal to increase PAL from 5% to 7.5%, while reducing the duty to 2.5% on certain electronics.

8. Excise Duty

An Excise is a somewhat tough tax to explain, since to the average joe, it sounds exactly like any other indirect tax (e.g. VAT). Unlike VAT however, Excises are levied on a narrow range of goods on a per unit basis (VAT, on the other hand is levied on a proportional basis, making it an ad valorem tax).

If, for instance, the Government levies an excise duty of Rs. X per 1,000 cigarettes, such a tax would be defined as a per unit tax. An ad valorem tax would be something like a property tax, or a sales tax, where the tax is calculated as a percentage of the purchase value.

Sri Lanka charges Excise duties on a few items ranging from Tobacco to Motor Vehicles. The recent hike in vehicle prices was also the result of a change in the way Excise duties were levied.

Excise duties are a key revenue earner for the Government, and contributed to 34% of the Government’s total tax revenue in 2015.

In other words, Excise duties are the single largest revenue earner for the Government. In a way, this makes chain smokers and heavy drinkers part of the economic engine that powers the country.

A breakdown of Sri Lanka’s Government revenue for the year 2015.

In closing, there is also this important fact that the authorities need to remember: higher taxes can be justified if a country’s citizens reap its benefits in the form of better healthcare, better roads, and better schools. Sri Lanka’s problem is that this is not happening. Accountability to the public, especially when it comes to Government expenditure, is nearly non-existent, forcing people to become disillusioned with the system.When taxpayers lose faith in the system, they will refuse to pay their fair share of taxes, which is bad for the Government’s coffers. The Government will then have to raise taxes at some point, which will force even more people to give the tax man the slip. This vicious cycle is what Sri Lanka should strive to avoid, since it will pretty much be the beginning of the end.