Unless you’ve been living under a rock lately, you must’ve heard about Fitch downgrading Sri Lanka’s credit rating. Much has been said about the move, and many op-eds will be published in the weekend newspapers, but what does it actually mean for our economy?

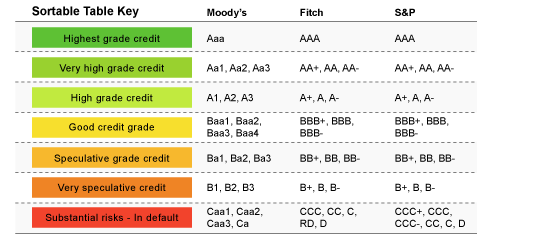

First up, you need to know what the purpose of a credit rating is, and who’s behind it. There are three credit rating agencies which rule the financial markets today. Known as the Big Three, the group is made up of Fitch, Moody’s and Standard & Poor’s. They exist to provide bond investors with some sort of a yardstick, with which to measure and compare the ‘creditworthiness’ of a country or a company.

And those letters which go something like BB+ and AA-? That’s the yardstick we were talking about, and it’s called a credit rating.

How different agencies rate issues and what they signify. Image Credit: The Wall Street Journal

Now what happened was that, one of these agencies, Fitch, decided to downgrade Sri Lanka’s credit rating to B+, from BB-, with a negative outlook. Fitch issued a statement detailing its reasons, which is standard practice in the industry.

Let’s now move on to a quick, short discussion of the statement issued by Fitch. We’re not going to go into a word by word breakdown, but rather a general, ‘broadly speaking’ kind of thing, so that everyone can understand what’s going on. If you fancy reading the entire statement released by Fitch, you can do so by clicking here.

What are the reasons for the downgrade?

-

Increasing refinancing risks and a strained external liquidity position

In other words, Fitch recognises that when the time comes to refinance our existing debt (which is this year), it might not be all smooth sailing. In general terms, refinancing refers to the act of replacing an existing debt obligation with another under different terms. Really, it’s no different than refinancing the mortgage on your house.

In the rest of the original statement, the agency goes on to talk about the pressure on our foreign reserves, and the probable need for support from the IMF and/or other similar institutions. -

Significant upcoming debt maturities

This part deals with the country’s debt service commitments. In an earlier article published here on Roar, we talked about how Sri Lanka has to pay up around USD 4 billion to its creditors, while we only have around USD 6.3 billion in foreign exchange reserves. This is largely what Fitch is talking about too.

You see, a loan comes with two parts: the principal and the interest. Governments normally borrow by issuing bonds, which are typically structured so that an interest payment is made periodically, while the principal is paid off in full at a later date, known as the maturity date. So what has happened is that the time has now come for us to pay back the principal, on some money which we borrowed a few years ago. We technically have the money to meet these obligations, but Fitch believes that such a significant payment could put our piggy bank in a very risky position.

Fitch also highlights the fact that we’re very susceptible to a change in how investors perceive us. If they (investors) think of Sri Lankan bonds as attractive despite the confusion surrounding the global economy right now, then we will be okay, but a movement in the opposite direction could obviously hurt us. -

Weak public finances

This has been a persistent issue with Sri Lanka for many years now, and much has been said about the need to exercise fiscal discipline AND also to increase government revenue. Fitch has thrown in some figures for comparison, but in short, we’re very bad at managing our money.

-

Decline in foreign exchange reserves

This is pretty straightforward. In the agency’s own words “Fitch has revised downwards its forecast for foreign-exchange reserves, with reserve coverage of current external payments now forecast to decline to 2.9 months in 2016 from an estimated 3.4 months in 2015. This forecast compares unfavourably with Fitch’s earlier forecast of 3.9 months for 2016 and is well below the ‘BB’ median of 4.2 months. While the authorities have undertaken certain measures to support external finances, including entering into bilateral swaps with other central banks, Fitch does not view this to be a sustainable way to improve the stability of the external finances.”

-

Vulnerability of high foreign currency debt to a significant depreciation in the exchange rate

Fitch believes that around 46% of the country’s debt is now denominated in foreign currencies. If the rupee weakens significantly, these debts will become more ‘expensive’ in rupee terms.

-

Favourable economic growth

These are the positive factors which sort of prevented the agency from downgrading us further. Again, it’s in plain English, so according to Fitch, “Sri Lanka’s macroeconomic performance remains stronger than some of its peers’ in the ‘B’ and ‘BB’ range with real GDP growth for the five-year period ending 2015 averaging close to 6%, compared with the ‘B’ median of 4.6% and ‘BB’ median of 3.9%. Sri Lanka also continues to score highly, compared with the ‘B’ median, on basic human development indicators, such as education, health and literacy, which is indicated by its favourable ranking in the UN’s Human Development Index. These relative structural strengths, combined with a clean external debt service record and smooth transition of power during the presidential and parliamentary elections in 2015 indicates a basic level of political stability, which supports the rating at ‘B+’.”

Does this impact me?

Last month the Central Bank did admit Sri Lanka had acquired a lot of debt in the past decade, and showed concern over the possibility of a rating downgrade. Image Credit: www.ft.lk

If you’re an average person who wakes up in the morning, goes to work, comes back home and has a nice, warm meal before hitting the hay, there’s nothing much you can do about this, so you shouldn’t really be too worried. On the other hand, policymakers will need to take this a little bit more seriously since an increase in the perceived ‘risk’ of Sri Lanka (in the eyes of global investors) will make it more expensive for us to borrow money.

Of course, that second part comes with a silver lining. Ideally, increased borrowing costs

would force the powers that be to take a good, hard look at how they deploy borrowed funds, and to sensibly prioritise government expenditure. (To their credit, the Central Bank did acknowledge the possibility of a rating downgrade)

There’s also something else that you need to know about credit ratings. These ratings are largely relative, and are based on judgements made using methodologies which are in certain ways, unique to each rating agency. With regard to Sri Lanka’s credit rating, Moody’s issued a statement recently (though it maintained its rating at B1) and S&P has held Sri Lanka’s credit rating at B+ for some time now. Credit ratings are not the be-all and end-all, but just one of the many tools used by investors when evaluating the attractiveness of a bond. At the end of the day, it is the big picture that matters to them.

Image Credit: reddit.com

Cover image credit: www.nineoclock.ro