Earlier this year, the January edition of this very report highlighted how the Colombo Stock Exchange had lost 840 points. When we published that article, the ASPI was hovering around the 6,200 mark. Fast forward to today and the very same ASPI is trading at around 6,500. In other words, the ASPI has managed to regain almost half of what it lost within the space of four or five months, depending on how you look at it.

A trader works the floor of the New York Stock Exchange. Image credit: IBTimes

They say time can heal a lot of wounds, but time, it appears, also has the power to turn stock markets around. That is why you should always aim to invest for the long run. Now that we’ve given you a free tip on investing, read on to know how the markets performed in May.

- The indices were pretty much flat, while investors greeted corporate earnings announcements with mixed feelings. The ASPI ended the month at 6,550.51, up just 0.53% compared to the beginning of the month. The S&P SL20 index, on the other hand, was at 3,425.57, down 0.29% compared to the beginning of the month. Apart from flat earnings, other aspects, like the tax hikes, also played a role in the lacklustre performance of the markets.

ASPI and S&P SL20 performances in May 2016. Data courtesy: Colombo Stock Exchange

- Since it was earnings season, scores of companies declared dividends. Those of you who are active investors should receive your counterfoils anytime soon, if you haven’t already.

Here’s to hoping your dividends are plentiful. Image credit: radicalcompliance.com

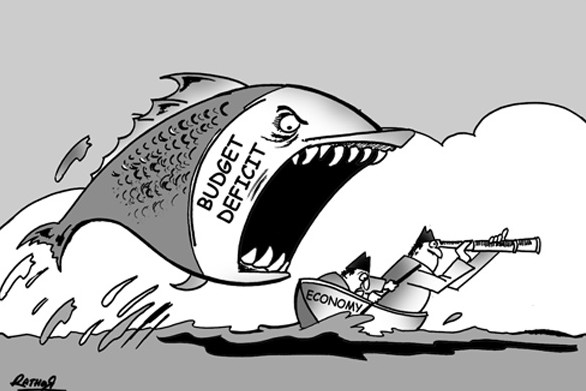

- Foreign investors turned net sellers in May, and sales by Foreign Institutional Investors amounted to Rs. 2.6 billion. Some were spooked by the state of Sri Lanka’s economy, while a considerable number of global asset managers left other markets for India. The arrival of the monsoons, and a healthy, growing economy means that global funds are falling over each other to snap up equities in Asia’s second most populous country.

In the following Bloomberg TV India video, Reserve Bank of India (RBI)

Governor Raghuram Rajan talks about why reforms are absolutely necessary to revive the Indian economy. Sri Lanka too, is in dire need of similar reforms.

As most Asian markets get battered, and the Federal Reserve of the United States prepares to increase interest rates, this space is going to heat up quite a bit ‒ with a weak home economy begging for reforms, every move of the Sri Lankan Government is going to have a big impact on the markets.

Stay tuned!

The comments, opinions and analyses presented herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Always seek independent advice.

Featured image courtesy adaderana.lk